How Much Spirits Are Canadians Drinking? Discover interesting 20 years trends

How Much Spirits Are Canadians Drinking?

Canada’s spirits market has undergone significant transformations over the past two decades, shaped by changing consumer preferences, economic conditions, and public health considerations. This comprehensive analysis examines current regional variations, historical trends, and future projections to provide valuable insights.

Table of Contents

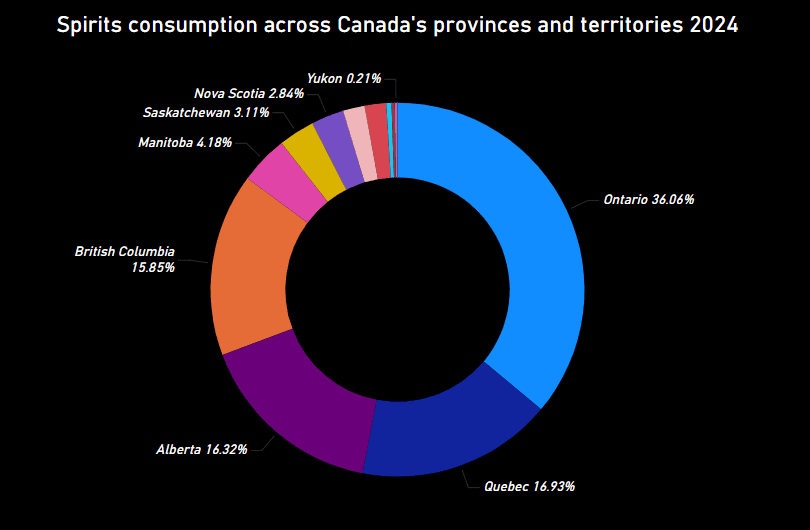

Regional Distribution and Consumption Patterns in 2024

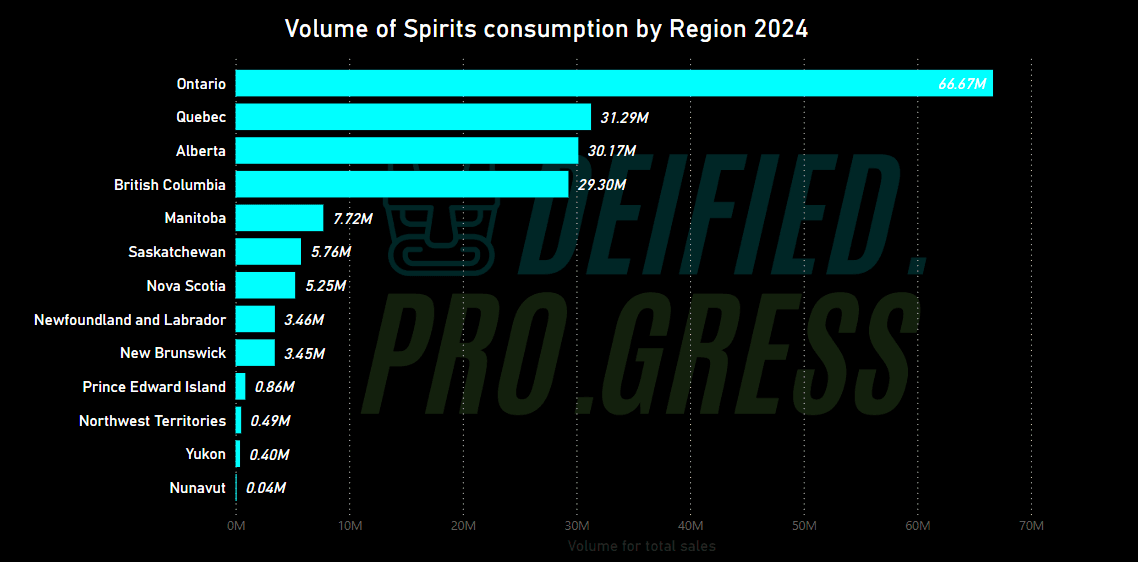

The provincial distribution of spirits consumption reveals Ontario’s dominant position in the Canadian market, accounting for 36.06% of all spirits consumed nationally. Quebec follows with 16.93%, while Alberta (16.32%) and British Columbia (15.85%) represent similar market shares. The remaining provinces and territories constitute significantly smaller portions, with Manitoba at 4.18%, Saskatchewan at 3.11%, Nova Scotia at 2.84%, and Yukon representing just 0.21% of national consumption.

However, this distribution presents only part of the story. When examining per capita consumption, a dramatically different picture emerges.

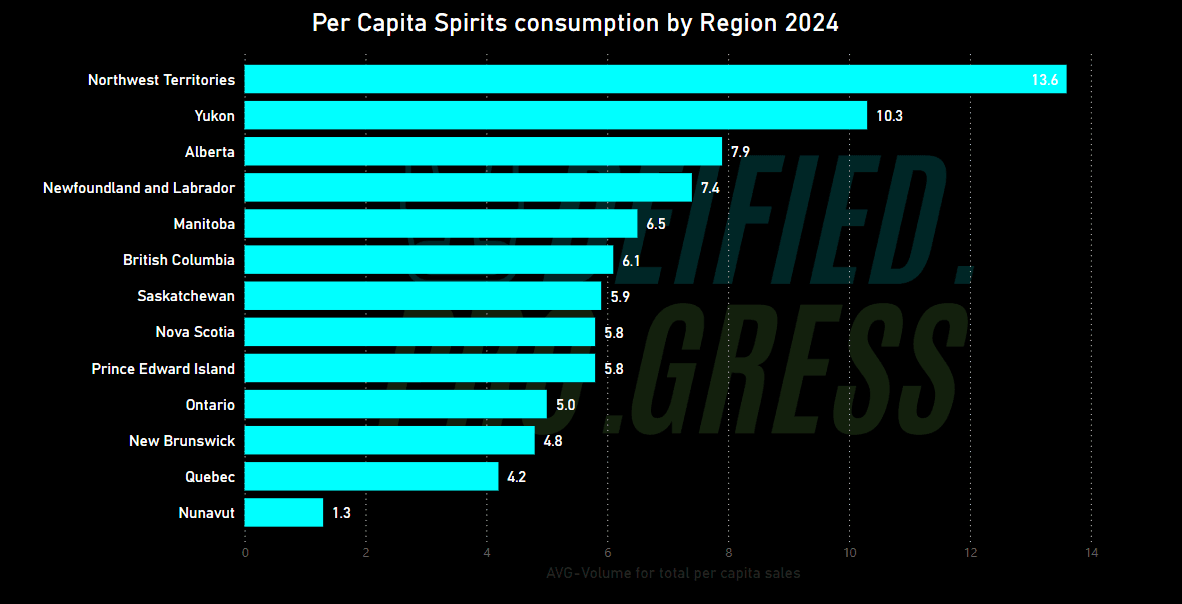

The territories lead per capita consumption significantly, with Northwest Territories residents consuming an average of 13.6 liters annually, followed by Yukon at 10.3 liters. This stark contrast with their minimal contribution to overall national consumption highlights the influence of population size on market distribution metrics. Alberta ranks third in per capita consumption at 7.9 liters, followed by Newfoundland and Labrador at 7.4 liters.

Interestingly, Ontario, despite dominating total consumption, ranks 10th in per capita terms at just 5.0 liters, while Quebec ranks second-to-last at 4.2 liters. This disparity underscores how population-adjusted metrics reveal vastly different consumption patterns than total volume figures alone. Nunavut stands as an outlier with just 1.3 liters per capita, potentially reflecting both demographic factors and access limitations.

Volume vs. Revenue: Premium Markets and Value Consumption

When examining total volume, Ontario’s market dominance is reinforced, with 66.67 million liters consumed annually. Quebec (31.29M), Alberta (30.17M), and British Columbia (29.30M) maintain their significant market presence. The volume drops considerably for the remaining provinces, with Manitoba at 7.72M liters and progressively smaller volumes for other regions.

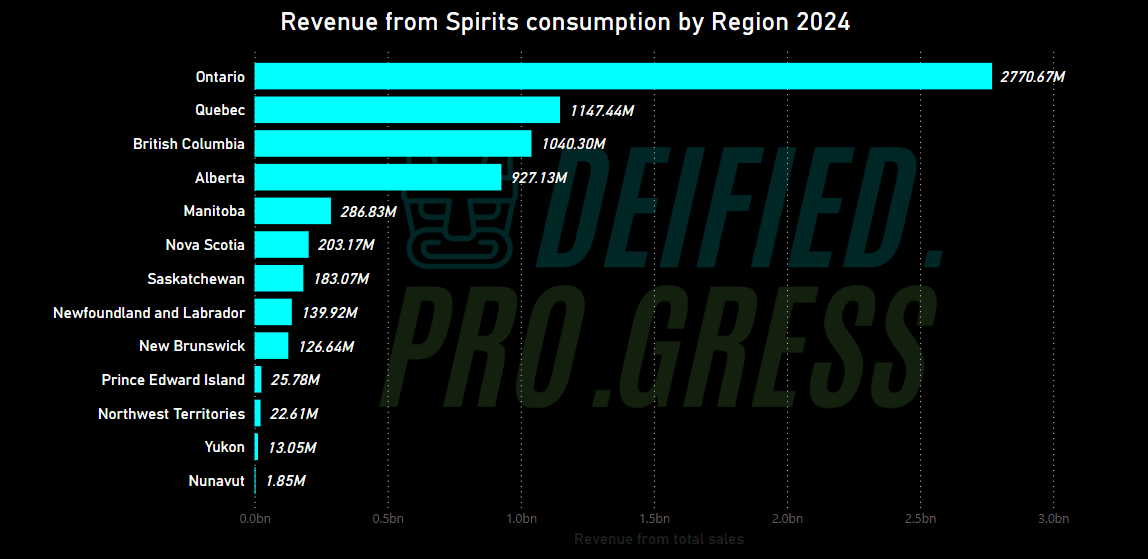

Revenue distribution follows a similar pattern, but with revealing differences in relative positioning. Ontario generates 2770.67 million dollars, maintaining approximately the same proportional lead in revenue as in volume. However, some provinces show interesting variations in their revenue-to-volume ratios:

| Province | Revenue (millions) | Volume (millions liters) | Revenue per Liter |

|---|---|---|---|

| Ontario | $2,770.67 | 66.67 | $41.56 |

| Quebec | $1,147.44 | 31.29 | $36.67 |

| British Columbia | $1,040.30 | 29.30 | $35.51 |

| Alberta | $927.13 | 30.17 | $30.73 |

| Manitoba | $286.83 | 7.72 | $37.15 |

British Columbia shows a higher revenue-to-volume ratio than Alberta, suggesting a greater preference for premium spirits or higher taxation rates. Manitoba, despite its modest volume, generates proportionally higher revenue per liter than Alberta, again indicating potential differences in consumer preferences for premium products or regional pricing strategies.

These discrepancies illuminate important regional variations in consumer behavior:

- Premium Markets: British Columbia and Ontario consumers appear more willing to pay premium prices for spirits.

- Volume Consumers: Alberta and Quebec consumers purchase larger volumes at relatively lower prices per unit.

- Northern Territories: Despite leading in per capita consumption, the territories contribute minimally to total revenue, suggesting different purchasing patterns or price points.

Long-term Growth and Recent Decline

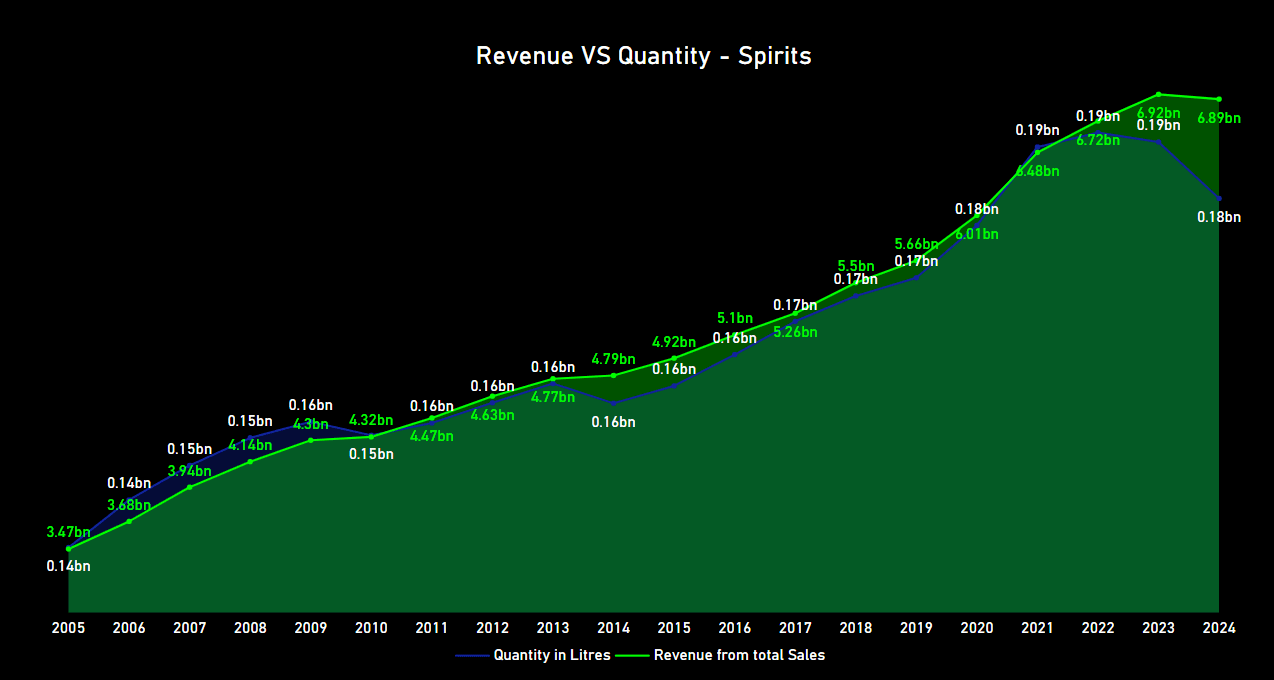

The 20-year trajectory of spirits consumption in Canada illustrates a remarkable growth story followed by a recent significant decline. From 2005 to 2021, both revenue and quantity demonstrated steady upward trends, with revenue growth outpacing volume increases – indicating a gradual premiumization of the market. Revenue grew from approximately 3.47 billion in 2005 to peak at around 6.89 billion in 2021, representing nearly a 100% increase over 16 years.

The quantity sold increased more moderately from 0.14 billion liters in 2005 to peak at 0.19 billion liters in 2021, representing about a 36% increase. This disparity between revenue and volume growth rates confirms a substantial shift toward higher-priced products throughout most of this period.

However, 2022 marked a pivotal turning point, with both revenue and quantity beginning to decline – a trend that has accelerated through 2024. This recent reversal demands closer examination to understand the factors driving this market correction.

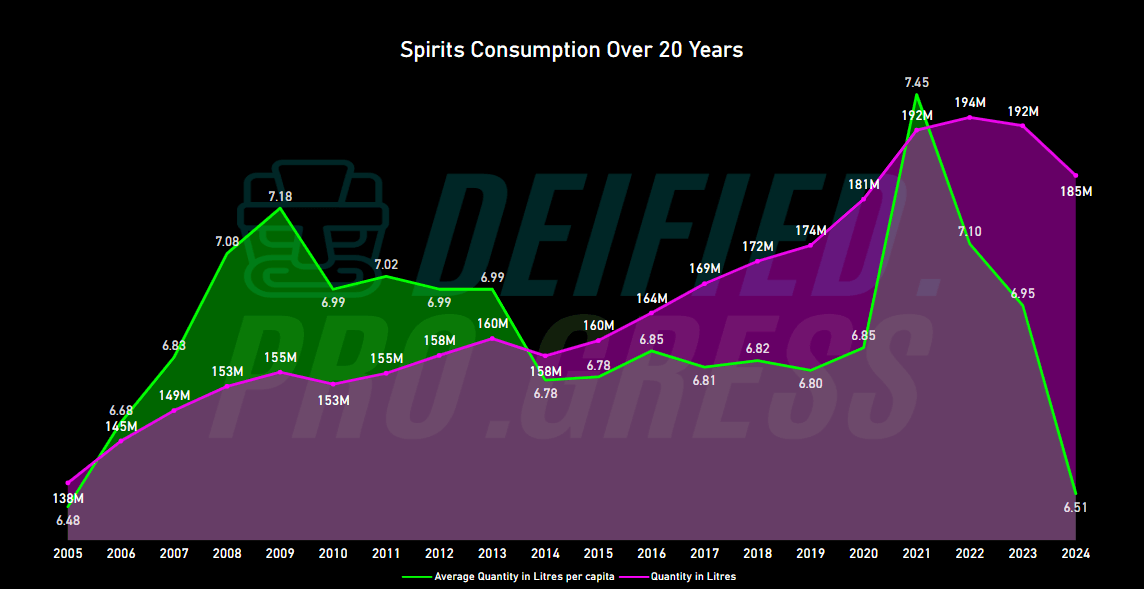

Per Capita Consumption Patterns and Absolute Quantity

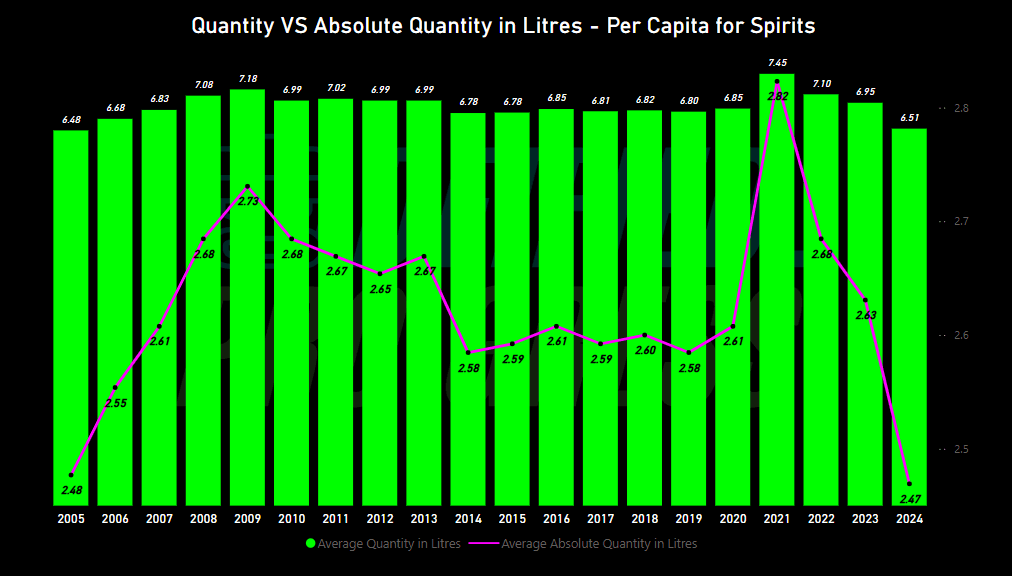

Per capita consumption patterns provide additional nuance to the overall market trajectory. Average quantity in liters fluctuated within a relatively narrow band between 6.48 and 7.45 liters per capita over the 20-year period, with peaks occurring in 2009 (7.18 liters) and notably in 2021 (7.45 liters).

The absolute quantity (represented by the purple line) shows more variation, with significant increases between 2005 and 2009, followed by a period of relative stability from 2010 to 2018. The dramatic spike in 2020-2021 corresponds with the COVID-19 pandemic, when home consumption increased substantially due to lockdowns and restrictions on on-premise establishments. The subsequent steep decline in 2022-2024 suggests a correction as consumer behavior normalized post-pandemic.

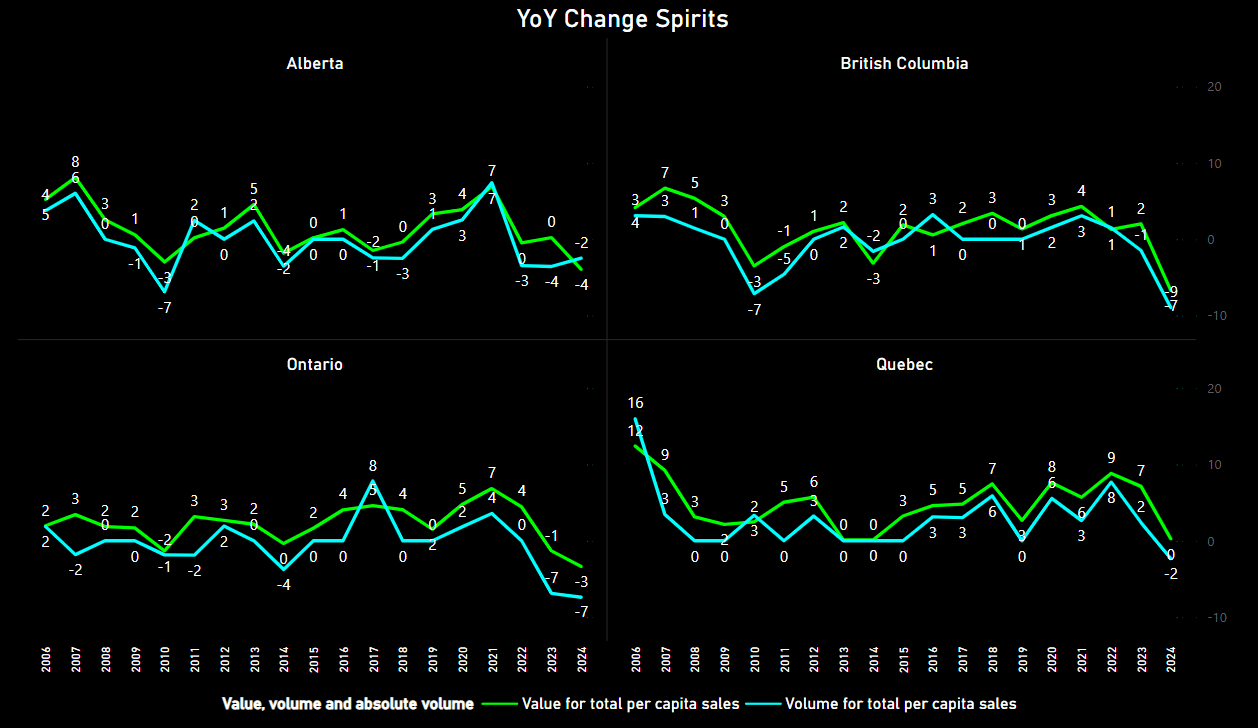

Regional Year-over-Year Changes: Diverse Trajectories

Year-over-year changes across major provinces reveal divergent patterns that warrant attention:

- Alberta

Alberta shows considerable volatility, with particularly strong negative growth in 2008-2009 (-7%) and again in 2023-2024 (-4%). The province experienced modest positive growth during most years between these downturns, with notable peaks in 2007 (+6%) and 2020 (+7%).

- British Columbia

British Columbia follows a somewhat similar pattern to Alberta, with significant negative growth in 2008-2009 (-7%) and 2023-2024 (-9%). However, BC demonstrated more consistent positive growth between 2015 and 2021.

- Ontario

Ontario maintained more stable growth overall, with fewer dramatic swings. The province experienced moderate positive growth in most years, with stronger performance in 2017-2018 (+8%) before facing a severe decline in 2023-2024 (-7%).

- Quebec

Quebec stands out with generally stronger and more positive growth than other provinces, particularly during 2006-2007 (+16%) and more sustained positive growth throughout the 2010s. Even in 2023-2024, Quebec experienced a milder decline (0%) compared to other major provinces.

These regional variations highlight how provincial economic conditions, regulatory environments, and consumer preferences create distinct market dynamics across Canada.

Consolidated View of 20-Year Consumption Trends

The area chart providing a consolidated view of 20-year consumption trends reveals several distinct phases in the Canadian spirits market:

- Growth Phase (2005-2009): Rapid increase in both total quantity and per capita consumption, reflecting economic prosperity and changing consumer preferences toward spirits.

- Stabilization Phase (2010-2015): Relatively flat per capita consumption with modest growth in total volume, indicating market maturation and population-driven expansion.

- Moderate Growth Phase (2016-2019): Gradual increases in both metrics, suggesting renewed consumer interest and potential category innovations.

- Pandemic Surge (2020-2021): Dramatic spike in both per capita consumption and total volume, reaching historical peaks as consumer behavior shifted substantially during COVID-19 lockdowns.

- Post-Pandemic Correction (2022-2024): Sharp decline in both metrics, potentially indicating market saturation, economic pressures, health consciousness, or normalization of consumption patterns as on-premise venues reopened.

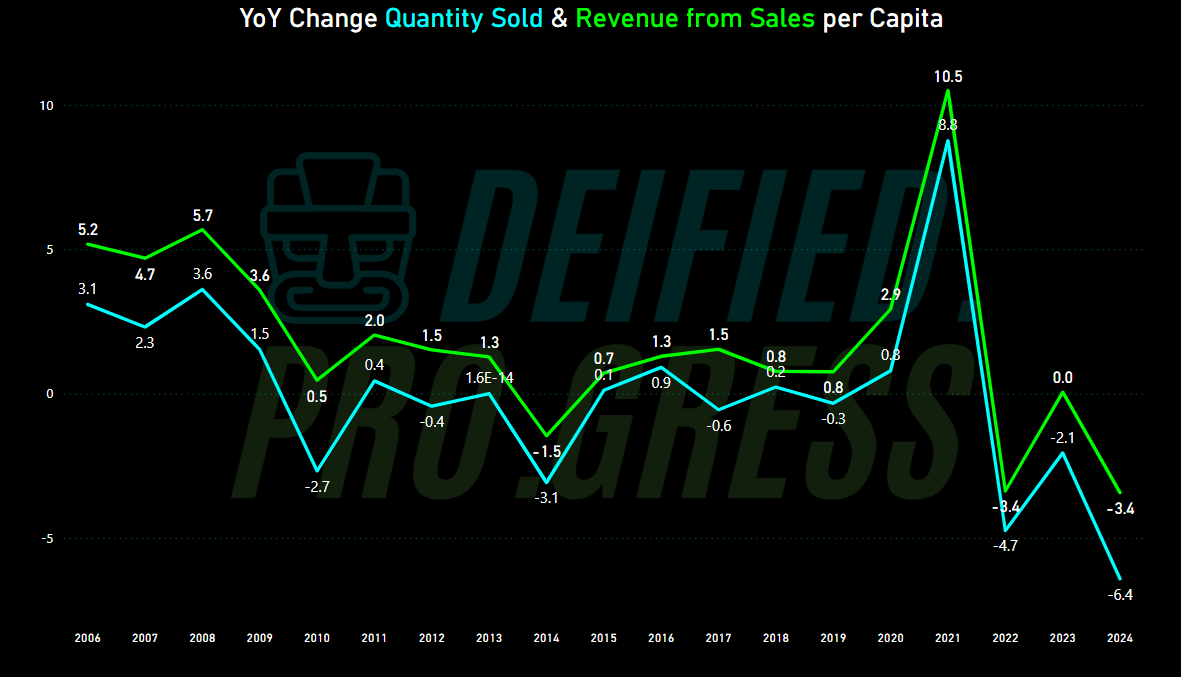

Year-over-Year Changes in Quantity and Revenue

Examining year-over-year changes in both quantity sold and revenue provides crucial insights into market dynamics:

- Healthy Growth Period (2006-2008): Both revenue and volume grew consistently, with revenue growth outpacing volume increases, indicating premiumization.

- Financial Crisis Impact (2009): Significant volume decrease (-2.7%) while revenue maintained modest growth (+1.5%), suggesting consumers reduced consumption but traded up to higher-quality products when they did purchase.

- Recovery and Stabilization (2010-2019): Alternating periods of modest growth and minor contraction, with revenue generally outperforming volume, continuing the premiumization trend.

- Pandemic Effect (2020-2021): Extraordinary growth in both metrics, with 2021 showing dramatic increases in both revenue (+10.5%) and volume (+8.8%), representing the market’s peak.

- Post-Pandemic Correction (2022-2024): Severe contraction, with 2024 showing volume declining faster (-6.4%) than revenue (-3.4%), suggesting consumers are reducing quantity but partially maintaining spending through premium purchases.

What does all this imply?

For spirits producers, distributors, and retailers, several strategic implications emerge from this analysis:

- Premiumization Remains Viable: Even during the recent market contraction, the smaller decline in revenue compared to volume suggests consumers continue to be receptive to premium offerings. This trend is particularly evident in British Columbia and Ontario, where revenue per liter exceeds the national average.

- Regional Targeting Is Critical: The significant variations in per capita consumption, price sensitivity, and growth trajectories across provinces necessitate tailored regional strategies. For example:

- Northern territories represent untapped potential for premium offerings given their high per capita consumption

- Quebec has demonstrated greater resilience to recent market contractions, suggesting continued growth opportunities

- Alberta’s volume-oriented consumption pattern may benefit from value-focused innovations

- Post-Pandemic Adaptation: The dramatic reversal from the 2021 peak requires industry adaptation through:

- Rightsizing production capacity and inventory management

- Exploring direct-to-consumer channels established during the pandemic

- Developing products aligned with at-home consumption occasions that persist post-pandemic

- Category Innovation Focus: With the overall market in contraction, category innovations become essential for maintaining consumer interest, such as:

- Low/no alcohol spirit alternatives addressing health consciousness

- Ready-to-drink premium cocktails bridging the convenience and quality gap

- Craft and locally-produced spirits capitalizing on “shop local” sentiment

For economists studying consumer behavior and market trends, the Canadian spirits landscape offers revealing insights:

- Market Maturation Signals: The recent volume decline after two decades of growth suggests the Canadian spirits market may be reaching maturity, with implications for:

- Industry consolidation potential

- Future capital investment patterns

- Employment trends in production and distribution

- Regional Economic Disparities: The significant variations in consumption patterns align with broader economic indicators:

- Higher per capita consumption in resource-dependent economies (Alberta, Newfoundland, territories)

- Premium consumption concentrated in diversified urban economies (Ontario, British Columbia)

- Quebec’s resilient growth potentially reflecting its distinct economic policies and cultural factors

- Pandemic Recovery Indicators: The spirits market correction offers a useful proxy for broader consumer behavior normalization:

- The steep decline suggests a faster-than-expected return to pre-pandemic consumption patterns

- Premium segment resilience indicates maintained disposable income despite inflation pressures

- Regional variations in recovery rates may signal differences in economic rebound strength

- Price Elasticity Insights: The differential between volume and revenue trends during contractions provides valuable data on price elasticity across different economic conditions and regions.

Future Outlook and Market Projections

The spirits market in Canada is clearly in a period of significant adjustment following the extraordinary peaks of 2021. This correction appears to be more than a simple return to pre-pandemic trends, with 2024 data showing consumption falling below 2019 levels. Several factors suggest this may represent a fundamental market realignment:

- Health Consciousness: Growing consumer focus on health and moderation may be permanently reshaping consumption patterns, with quantity reductions partially offset by trading up to premium products for occasional indulgence.

- Generational Shift: Younger consumers are demonstrating different alcohol preferences and consumption patterns than previous generations, with some evidence of lower overall consumption and greater interest in non-alcoholic alternatives.

- Category Competition: The spirits category faces increased competition from ready-to-drink beverages, premium non-alcoholic options, and cannabis products in the recreational substance market.

- Economic Pressures: Inflationary pressures and economic uncertainty may be contributing to reduced discretionary spending on spirits, particularly in the volume-driven segments of the market.

The future outlook varies significantly by region, with distinct opportunities and challenges:

- Quebec’s Resilience: Quebec’s relative stability in 2023-2024 suggests continued growth potential in this market, particularly for premium products aligned with the province’s food culture and European influences.

- Northern Territory Potential: Despite their small population, the territories represent untapped potential for premium and craft offerings given their extraordinary per capita consumption rates.

- Alberta’s Recovery Prospects: Alberta’s resource-dependent economy may see consumption patterns rebound more quickly with economic recovery, though the province’s current trend mirrors the national contraction.

- Ontario and BC Premium Focus: These provinces are likely to see continued premiumization even as volumes contract, requiring industry focus on higher-margin products and enhanced consumer experiences.

The current data suggests the market correction may continue through 2024-2025 before reaching a new equilibrium. Several indicators will signal when this stabilization occurs:

- Volume Decline Moderation: A slowing of the year-over-year volume decreases below 2%, indicating the market is finding its new baseline.

- Revenue Growth Resumption: Positive revenue growth despite flat or slightly negative volume would confirm the premiumization trend has sufficient strength to drive market recovery.

- Regional Convergence: Reduced disparity in year-over-year changes across major provinces would suggest broader market stabilization rather than region-specific factors driving changes.

- Innovation Success Metrics: Successful new product categories achieving scale would indicate the market’s ability to reinvent itself in response to changing consumer preferences.

Conclusion: A Market at an Inflection Point

The Canadian spirits market stands at a critical juncture after two decades of growth followed by an unprecedented pandemic surge and subsequent correction. This analysis reveals a complex landscape where regional variations, premiumization trends, and shifting consumer preferences create both challenges and opportunities for all stakeholders.

The data suggests a market in transition rather than decline, with volume contraction partially offset by value growth in several regions. Industry participants who successfully navigate this transition through regional targeting, premium positioning, and consumer-focused innovation will emerge well-positioned for the next phase of market development.

For policymakers, the current market correction offers an opportunity to reassess regulatory frameworks and taxation strategies to balance revenue generation, public health objectives, and industry sustainability. Economists will find valuable signals in the regional disparities and price elasticity insights revealed by this analysis.

As the market seeks its new equilibrium in the coming years, continued monitoring of these trends will be essential for all stakeholders seeking to understand and influence the future of spirits consumption in Canada.

- How Much Wine Are Canadians Drinking in 2025?

- How Much Cider Are Canadians Drinking in 2025?

- How Much Beer Are Canadians Drinking in 2025?

- How Much Alcohol Are Canadians Drinking in 2025?

Sources

Statistics Canada. Table 10-10-0010-01 Sales of alcoholic beverages types by liquor authorities and other retail outlets, by value, volume, and absolute volume