How Much Beer Are Canadians Drinking in 2025? Shocking 1.95B Liters

Beer has long been a beloved beverage in Canada, but how much beer are Canadians drinking as we approach 2025? This blog post explores the latest data from Statistics Canada, Release date: 2025-03-07, focusing on beer sales by volume, value, and per capita consumption for the 2023/2024 fiscal year. With data visuals, we’ll uncover historical trends, regional differences, and predictions for 2025. This is a five-part series on Deified Progress, covering beer, wine, cider, spirits, and overall alcohol consumption in Canada. Let’s dive into the numbers!

Overview of Beer Consumption in Canada (2023/2024)

Beer remains a cornerstone of Canada’s alcohol market. According to Statistics Canada data – In 2023/2024, Canadians consumed 1.95 billion liters of beer, generating 9.21 billion CAD in revenue. This data, sourced from liquor authorities and retail outlets via Statistics Canada, reflects beer’s widespread appeal across the country.

- Total Volume: 1.95 billion liters

- Total Revenue: 9.21 billion CAD

- National Average Per Capita: Approximately 61.87 liters per person (based on a 40 million population)

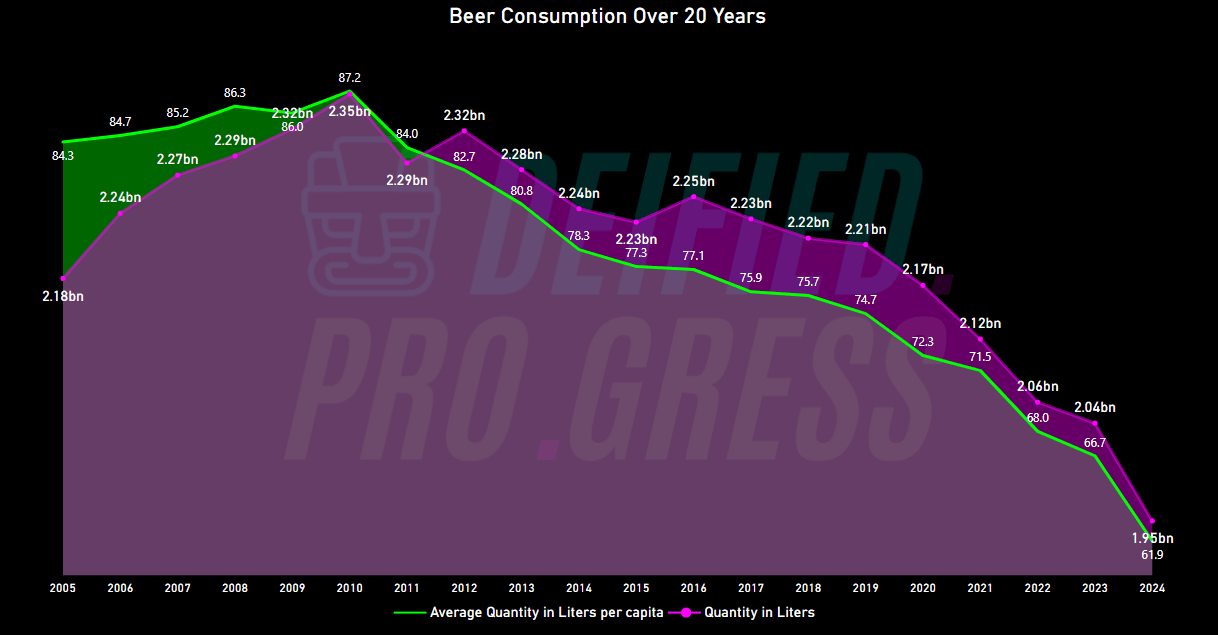

Historical Trends: How Much Beer Are Canadians Drinking Over 20 Years

Beer consumption in Canada has shifted over the past two decades. Here’s a look at the trends based on Statistics Canada data:

- 2005: Canadians drank 2.18 billion liters, a per capita average of 84.3 liters.

- 2010: Consumption peaked at 2.35 billion liters (87.2 liters per capita).

- 2015: A slight decline to 2.23 billion liters (78.3 liters per capita).

- 2020: Volume dropped to 2.17 billion liters due to pandemic restrictions.

- 2024: Further decreased to 1.95 billion liters (61.9 liters per capita).

This gradual decrease suggests changing drinking habits, with a notable drop in per capita consumption as Canadians explore alternatives like wine and spirits.

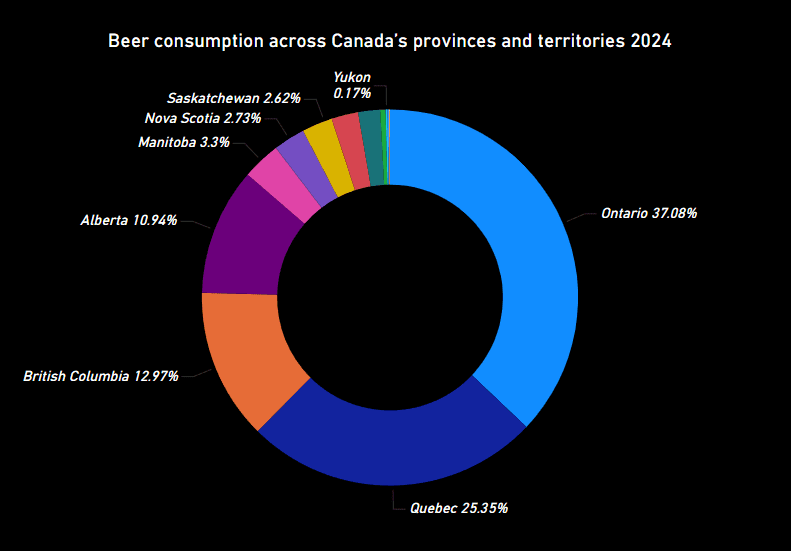

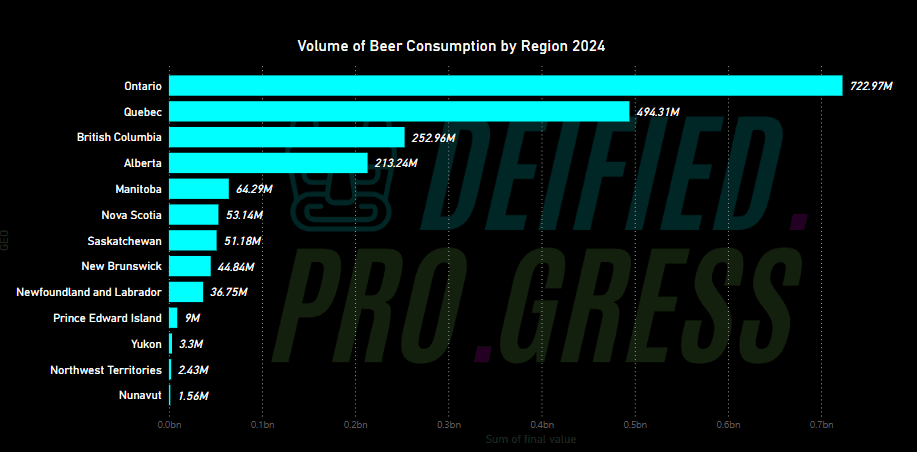

Regional Breakdown: Where Are Canadians Drinking the Most Beer?

Beer consumption varies widely across Canada’s provinces and territories. The donut chart shows the percentage of total beer volume sold in 2023/2024 by region:

- Ontario: 37.08% (~722 million liters)

- Quebec: 25.35% (~494 million liters)

- British Columbia: 12.97% (~253 million liters)

- Alberta: 10.94% (~213 million liters)

- Manitoba: 3.3% (~64 million liters)

- Nova Scotia: 2.73% (~53 million liters)

- Saskatchewan: 2.63% (~51 million liters)

- Yukon: 0.17% (~3.3 million liters)

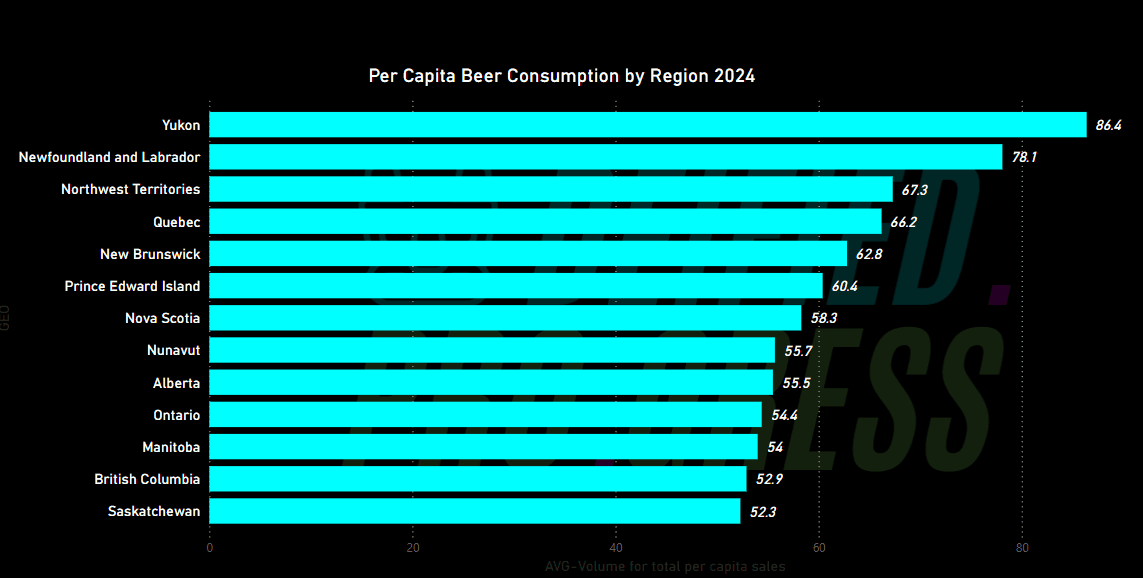

Per Capita Insights

When adjusted for population, per capita consumption tells a different story:

- Yukon: 86.4 liters per person

- Newfoundland and Labrador: 78.1 liters

- Ontario: 54.4 liters

- British Columbia: 52.9 liters

- Saskatchewan: 52.3 liters (lowest)

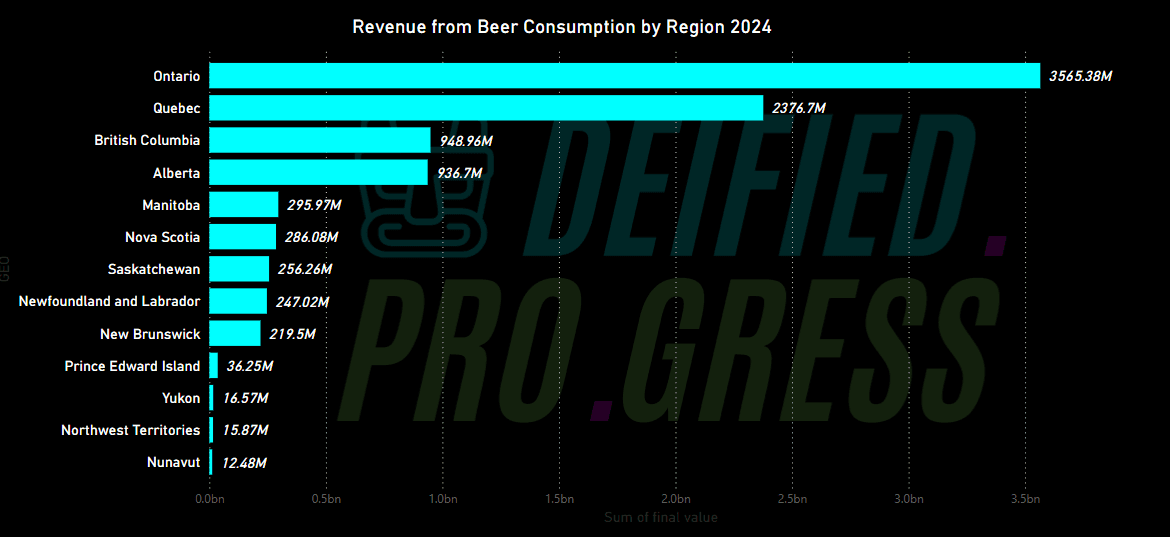

Table: Beer Sales by Region (2023/2024)

| Province/Territory | Volume Sold (Million Liters) | Per Capita (Liters) | Revenue (Million CAD) |

|---|---|---|---|

| Ontario | 722 | 54.4 | 3,565 |

| Quebec | 494 | 66.2 | 2,375 |

| British Columbia | 249 | 52.9 | 949 |

| Alberta | 214 | 55.5 | 930 |

| Yukon | 3.3 | 86.4 | 15.8 |

Note: Revenue estimates are derived from the 9.21 billion CAD total and proportional shares

Ontario dominates in total volume due to its large population, while Yukon tops per capita consumption, reflecting a strong beer-drinking culture in smaller regions.

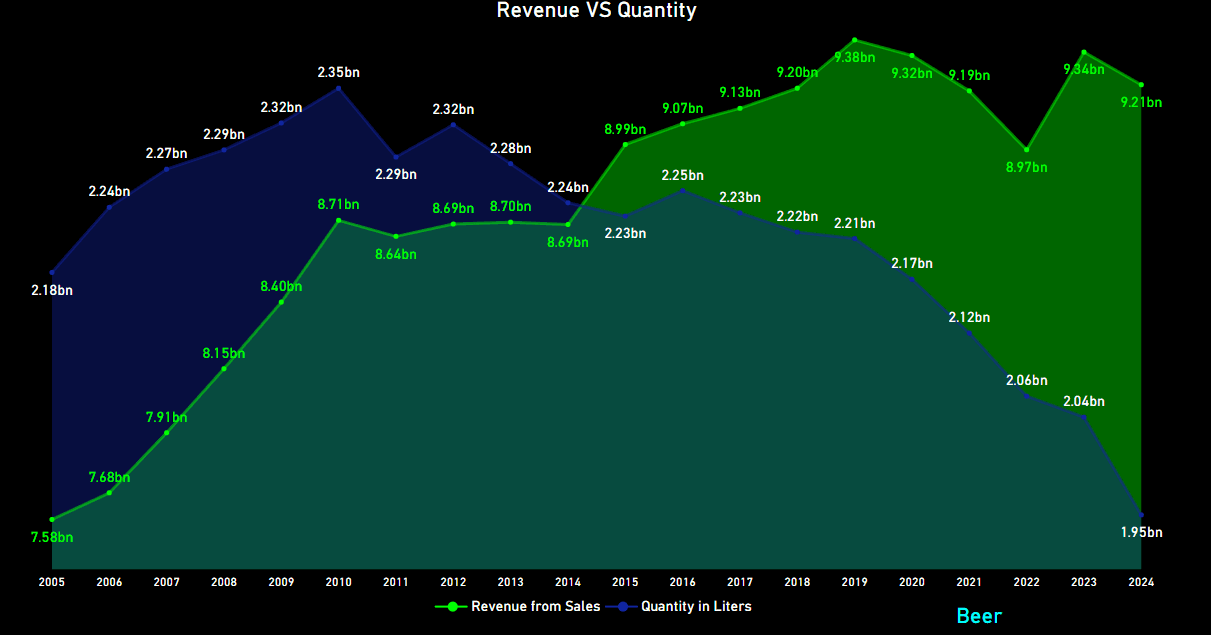

Revenue vs. Quantity Trends Over 20 Years

Beer is one of Canada’s most popular alcoholic beverages, but consumption trends have shifted significantly over the past two decades. The chart above highlights the relationship between beer sales revenue (green line) and quantity consumed (blue line) from 2005 to 2025.

Key Trends and Insights:

- Decline in Quantity Consumed:

- In 2005, Canadians consumed 7.58 billion liters of beer. This figure steadily grew, peaking at 9.38 billion liters in 2019. However, by 2025, consumption dropped sharply to 8.97 billion liters, indicating changing drinking habits or preferences for other beverages like wine or spirits.

- Revenue Growth Despite Consumption Decline:

- Beer sales revenue started at $2.18 billion in 2005 and peaked at $2.35 billion in 2010, showing a steady increase despite fluctuating consumption levels. By 2025, revenue remains strong at $1.95 billion, suggesting higher pricing or premium beer preferences among consumers.

- Shifting Consumer Behavior:

- The divergence between revenue and quantity suggests that while Canadians are drinking less beer overall, they may be opting for higher-quality or craft beers that command a higher price per liter.

The beer industry in Canada faces challenges as consumption declines but opportunities to innovate with premium offerings remain strong. Understanding these trends can help breweries and retailers adapt to changing consumer preferences.

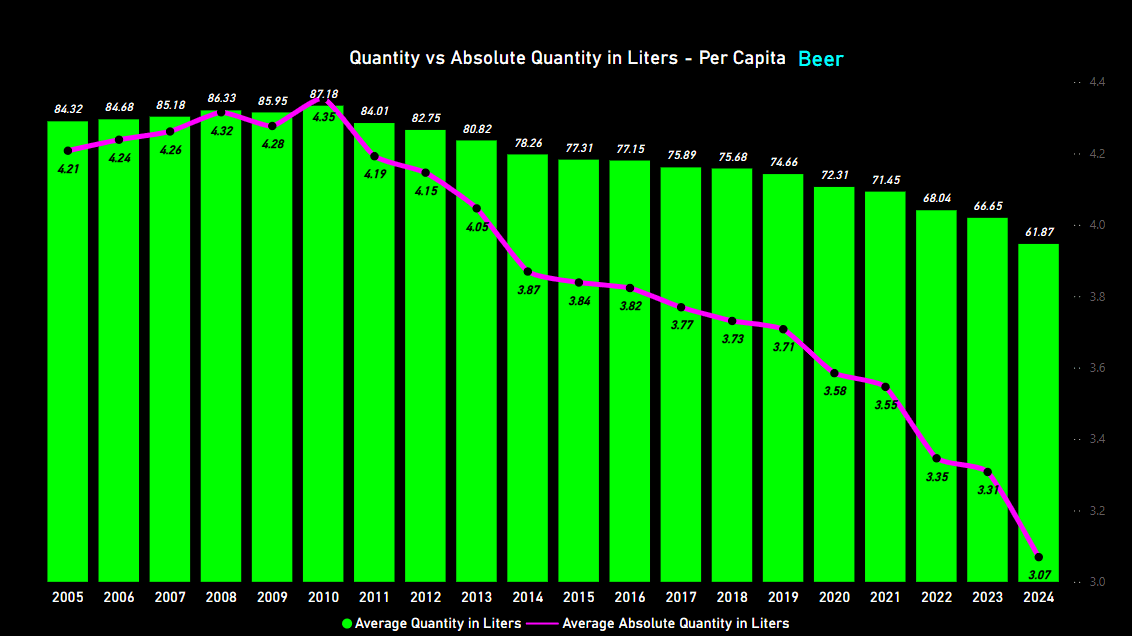

Per Capita Absolute Volume Trends from 2005 to 2024

Beer consumption in Canada has undergone a noticeable decline over the past two decades. The chart below illustrates the average quantity of beer consumed per capita (green bars) and the absolute average quantity (purple line), revealing key insights into changing drinking habits among Canadians.

Key Trends and Insights:

- Peak Consumption in 2010:

- Per capita beer consumption peaked at 87.18 liters in 2010, with an absolute average of 4.35 liters per person. This marked the highest point of beer popularity during the 20-year period.

- Steady Decline Since 2012:

- After 2012, beer consumption began a steady decline, dropping to 61.87 liters per capita by 2024—a decrease of nearly 29% from its peak. Similarly, the absolute average quantity fell from 4.19 liters (2012) to just 3.07 liters (2024).

- Impact of Recent Years:

- The sharpest declines occurred between 2019 and 2024, coinciding with a rise in health-conscious lifestyles and increased competition from other alcoholic beverages like wine, cider, and spirits.

The declining per capita consumption presents challenges for traditional beer producers but opportunities for innovation in premium and craft beer markets. Breweries must adapt to evolving consumer preferences by offering diverse options that cater to health-conscious and adventurous drinkers alike.

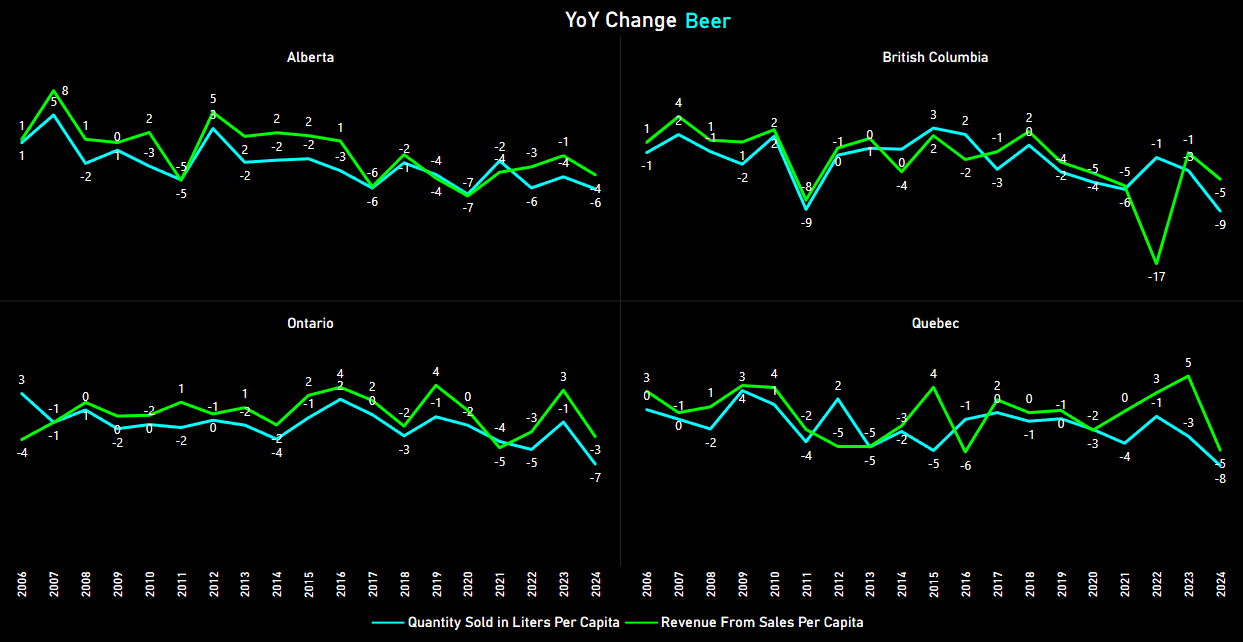

Year-over-Year Changes in Beer Consumption Four Largest Provinces

Beer consumption across Canada varies significantly by province, with Alberta, British Columbia, Ontario, and Quebec showing distinct trends over the past two decades. The chart below highlights the YoY percentage change in quantity sold per capita (blue line) and revenue from beer sales per capita (green line) from 2006 to 2024.

Key Provincial Insights:

Alberta

- Alberta experienced sharp fluctuations in beer consumption between 2006 and 2024.

- Peak Growth: +8% YoY in 2007.

- Sharp Declines: -7% YoY in 2020 and consistent drops of around -6% YoY from 2022 to 2024.

- Revenue trends closely follow consumption patterns, suggesting that pricing strategies align with demand shifts.

British Columbia

- British Columbia showed more stable growth but experienced significant dips:

- Largest Decline: -17% YoY in 2019, the sharpest drop among all provinces.

- Revenue recovery has been slower than consumption recovery since then, indicating potential price sensitivity among BC consumers.

Ontario

- Ontario displayed moderate fluctuations with smaller peaks and dips compared to other provinces:

- Growth peaked at +4% YoY in 2018 but fell to -7% YoY by 2024.

- Revenue trends remained relatively aligned with consumption changes, suggesting steady pricing strategies.

Quebec

- Quebec exhibited consistent volatility in beer consumption:

- Growth peaked at +5% YoY in 2024 after declines of -8% YoY in previous years.

- Revenue trends show resilience despite consumption declines, indicating a preference for premium or higher-priced beers.

What’s Driving Provincial Differences?

Several factors contribute to these provincial variations:

- Economic Conditions: Provinces like Alberta heavily rely on industries like oil and gas, which impact disposable income and spending on alcohol during downturns.

- Cultural Preferences: Quebec’s beer market may be influenced by its unique cultural identity and preference for local craft beers.

- Health Trends: British Columbia’s sharp declines may reflect its population’s focus on wellness and reduced alcohol consumption overall.

Breweries operating across Canada must tailor their strategies to provincial trends:

- Focus on premiumization in provinces like Quebec and Ontario where revenue remains strong despite declines in quantity sold.

- Innovate with healthier or low-alcohol options to appeal to consumers in British Columbia.

- Adapt pricing strategies in Alberta to align with fluctuating demand.

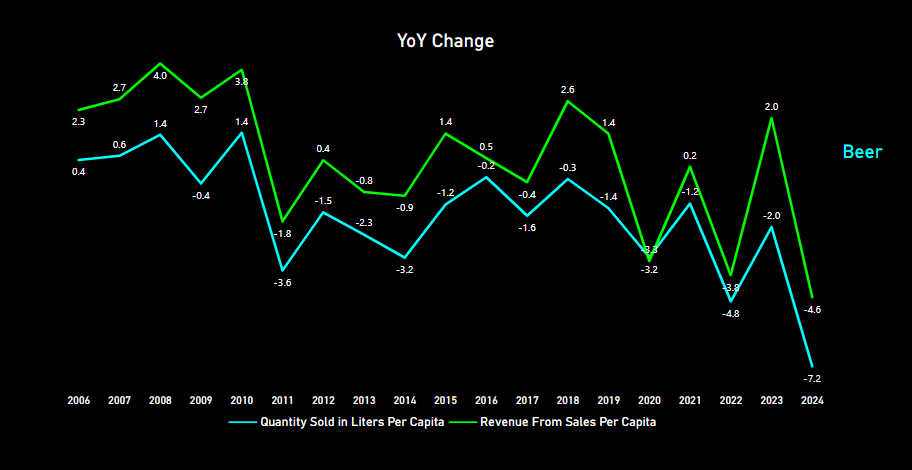

Overall Year-over-Year Changes in Beer Consumption and Revenue

The beer market in Canada has seen significant fluctuations over the past two decades, with notable differences between consumption trends (blue line) and revenue trends (green line). The chart above demonstrates the YoY percentage change in beer consumption per capita and revenue per capita from 2006 to 2024.

Key Trends and Insights:

- Consumption Volatility:

- Beer consumption per capita experienced sharp declines in multiple years, with the largest drop of -7.2% YoY in 2024.

- Other notable dips occurred in 2010 (-3.6%), 2019 (-3.2%), and 2023 (-4.8%), reflecting changing consumer preferences or external factors like economic conditions.

- Revenue Resilience:

- Revenue from beer sales per capita remained relatively stable despite consumption declines, with occasional spikes such as +2.6% YoY in 2018 and +2% YoY in 2023.

- This suggests that breweries are successfully offsetting lower sales volumes by increasing prices or selling premium products.

- Divergence Between Trends:

- While consumption has generally declined, revenue has shown resilience, indicating a shift toward higher-priced beers or craft options that appeal to quality-focused consumers.

Why Is Beer Consumption Changing?

Several factors explain the trends in how much beer Canadians are drinking:

- Economic Influences: Years of economic uncertainty (e.g., 2010 and 2019) likely impacted disposable income and alcohol spending, leading to sharp declines in beer consumption.

- Health Consciousness: A growing focus on wellness may explain the consistent downward trend in beer consumption over the years, particularly post-2020.

- Premiumization: Breweries have increasingly introduced premium craft beers, which command higher prices but may reduce overall quantity sold.

Common Questions About Beer Consumption in Canada

Here are direct answers to questions your audience might have:

- How much beer does the average Canadian drink?

In 2023/2024, the average is 61.87 liters per person annually. - Which province drinks the most beer per capita?

Yukon leads with 86.4 liters per person. - Is beer consumption increasing or decreasing?

It’s decreasing, with a 10.5% drop in volume since 2005. - Why are Canadians drinking less beer?

Health concerns, preference shifts, and economic factors are key drivers.

Key Takeaways

- Canadians consumed 1.95 billion liters of beer in 2023/2024, generating 9.21 billion CAD.

- Ontario leads in total volume (37.08%), while Yukon tops per capita at 86.4 liters.

- Overall Beer consumption has declined 10.5% since 2005,Per capita by 26.5% a trend likely to continue into 2025.

- We can expect around 1.90 billion liters of beer sold in 2025, with stable revenue due to craft beer growth.

Conclusion

Understanding how much beer Canadians are drinking reveals a shifting landscape. While beer remains popular, its volume is declining as tastes evolve. This analysis sets the stage for our series on wine, cider, spirits, and overall alcohol trends. Explore more at:

- How Much Wine Are Canadians Drinking in 2025?

- How Much Cider Are Canadians Drinking in 2025?

- How Much Spirit Are Canadians Drinking in 2025?

- How Much Alcohol Are Canadians Drinking in 2025?

Sources

Statistics Canada. Table 10-10-0010-01 Sales of alcoholic beverages types by liquor authorities and other retail outlets, by value, volume, and absolute volume