5 Smart Money Management Strategies for Building Lasting Wealth

Smart money management in income, debt, expenses, savings, and investments is crucial for long-term financial success. By balancing these five areas, you can grow your wealth, reduce stress, and secure your family’s future. Think of money as a tree: saving is like watering, debt management is pruning, and investing is the sunlight that fuels growth. Income lays the foundation, while savings nurture it. Managing debt removes obstacles, and smart investments accelerate growth. When managed effectively, your financial tree becomes strong, ensuring stability and prosperity for generations.

1. Income: The Engine of Financial Stability And Smart Money Management

Income—whether earned through jobs, side hustles, or businesses—forms the foundation of all financial decisions. It provides the resources to cover expenses, save, manage debt, and invest for the future.

Why Income Matters Everywhere

- Stability Reduces Stress: Having a predictable monthly income helps eliminate financial surprises, reducing stress. In the U.S., 64% of adults experiencing financial stress report related health issues such as headaches or poor sleep (source).

- Higher Earnings Build Wealth Faster: Education plays a critical role in boosting income. Workers with a master’s degree in the U.S. earn nearly twice as much weekly ($1,737) compared to those with only a high school diploma ($899). Similarly, Australian university graduates earn 75% more over their careers than non-graduates (source).

- Remote Work Opportunities: The global shift toward remote work has expanded earning potential. Professionals in countries like India and the Philippines can now earn salaries comparable to those in higher-income nations without relocating. On average, remote workers earn $4,000 more annually than their on-site counterparts (source).

Building Generational Wealth Through Income

- Diversify Income Streams: Families that rely on multiple income sources—such as salaries, rental properties, or investments—are better equipped to handle economic shocks like job losses. For example, 40% of Canadian millionaires generate income from both employment and investments (source).

- Teach Financial Literacy Early: Teaching children about money management can have lasting benefits. In the U.K., teens who discuss household budgets with their parents are 30% more likely to develop regular saving habits as adults (source).

Income and Financial Well-Being

Research shows that while higher income improves financial well-being, other factors like behavior also play a significant role. For instance, Canadians earning above $50,000 experience a marked increase in financial well-being scores. However, beyond $150,000, the improvement plateaus unless paired with effective money management practices (source).

Health and Income Connection

Income is closely tied to health outcomes. In the U.S., individuals in the top 1% of earners live an average of 10–15 years longer than those in the bottom 1%. Additionally, every $15,000 increase in household income significantly reduces health risks such as chronic diseases and mental health issues (source).

The Role of Education in Income Growth

Investing in education leads to substantial income growth over time. For example:

- Improved math skills can increase annual earnings by $21,000.

- Better reading and writing skills can add $11,000 annually. These findings underscore the importance of lifelong learning and skill development to enhance earning potential (source).

2. Debt: The Good vs. The Dangerous Part Of Smart Money Management

Debt can act as a double-edged sword—when used wisely, it can be a tool for building wealth, but when mismanaged, it can become a significant barrier to financial freedom. Understanding the difference between good debt and bad debt is essential for making informed financial decisions.

Types of Debt Across Countries

- Good Debt: Good debt refers to borrowing that contributes to long-term wealth creation or income generation. Examples include mortgages, student loans, and business loans. For instance:

- In Canada, homeownership enables families to accumulate 40 times more wealth than renters, as property values tend to appreciate over time. However, disparities persist; in the U.S., there is a 30% homeownership gap between Black and white families, limiting wealth-building opportunities for minorities (source).

- Mortgages are considered good debt because they allow individuals to build equity in appreciating assets like homes. Over time, this equity can be leveraged for further investments or financial security (source).

- Student loans are another form of good debt, as they often lead to higher earning potential. For example, U.S. workers with bachelor’s degrees earn approximately $1 million more over their lifetimes than those with only high school diplomas (source).

- Bad Debt: Bad debt typically involves borrowing for expenses that do not generate income or appreciate. Examples include credit card debt and payday loans:

- U.S. households pay an average of $1,300 annually in credit card interest, which could otherwise be invested or saved. This type of high-interest debt often traps individuals in a cycle of repayment (source).

- Payday loans are particularly problematic; in the U.K., 60% of payday loan users borrow again within a year, perpetuating financial instability (source).

Breaking the Debt Cycle

To escape the burden of bad debt and leverage good debt effectively, consider the following strategies:

- Use the Snowball Method:

The snowball method involves paying off smaller debts first to achieve quick wins and build momentum before tackling larger debts. Studies show that this approach increases success rates by 20% compared to other repayment methods (source). - Refinance High-Interest Debts:

Refinancing can significantly reduce monthly payments and save money on interest. For example, in 2024, 35% of U.S. homeowners refinanced their mortgages, saving an average of $200 per month (source). - Consolidate Debts:

Consolidating high-interest debts into a single loan with a lower interest rate simplifies repayment and reduces overall costs. This strategy is particularly effective for managing credit card balances (source). - Avoid Over-Leveraging:

Borrow only what you can comfortably repay without straining your finances. Over-leveraging—borrowing too much relative to your income—can lead to financial distress if unforeseen expenses arise (source).

The Role of Good Debt in Wealth Creation

Good debt can be a powerful tool for building wealth when used strategically:

- Real Estate Investments: Borrowing to invest in rental properties allows you to generate passive income while benefiting from property appreciation over time (source).

- Small Business Loans: Entrepreneurs can use loans to start or expand businesses, creating additional income streams and long-term financial growth (source).

- Education Loans: Investing in higher education enhances earning potential and career opportunities, making it one of the most effective forms of good debt (source).

3. Savings: Your Financial Safety Net Of Smart Money Management

Savings serve as a critical financial buffer, offering protection against unexpected events and enabling long-term financial goals. By consistently saving, individuals and families can avoid reliance on debt during crises and achieve greater financial stability.

Why Savings = Security

- Emergency Funds Reduce Reliance on Debt:

Emergency savings act as a safeguard during financial hardships, such as medical emergencies or job loss. For example: - Global Savings Trends:

Despite the importance of emergency funds, many individuals struggle to save:- Only 44% of Americans can cover a $1,000 emergency expense, compared to 67% of people in the U.K., highlighting disparities in financial preparedness (source).

- Protection Against Financial Crises:

During economic downturns or recessions, having liquid savings prevents individuals from needing to sell long-term investments or incur penalties for early withdrawals (source).

Saving for Generational Wealth

- Automate Savings for Consistency:

Automation ensures regular contributions to savings accounts, making it easier to build wealth over time. For instance:- Canadians who automatically save 10% of their income are three times more likely to retire comfortably (source).

- Leverage Tax-Advantaged Accounts:

Specialized savings tools like education or retirement accounts can significantly grow wealth over time:- In the U.S., 529 plans allow tax-free growth for education savings. Saving just $200 monthly from birth can grow to over $75,000 by age 18, assuming an average annual return of 6% (source).

- In the U.K., Junior ISAs (Individual Savings Accounts) offer similar tax advantages for building education or general-purpose funds (source).

- Savings as a Wealth Transfer Tool:

Families with robust savings can pass down financial security to future generations, reducing reliance on debt and providing opportunities like higher education or homeownership (source).

Strategies for Building Savings

- Start Small and Scale Up:

Begin saving even small amounts regularly—such as $5 daily—to establish the habit. Over time, these contributions compound significantly when invested wisely (source). - Create Specific Goals:

Define short-term (e.g., emergency fund), medium-term (e.g., vacation), and long-term (e.g., retirement) goals. Writing them down increases focus and commitment (source). - Use High-Yield Savings Accounts:

Storing emergency funds in high-interest accounts ensures liquidity while earning returns above inflation rates (source). - Avoid Lifestyle Inflation:

As income grows, maintain current spending levels and allocate raises toward savings instead of discretionary expenses (source).

The Role of Employers in Savings

Employers are increasingly offering emergency savings benefits as part of workplace retirement plans: Under SECURE 2.0 legislation in the U.S., employees can now save up to $2,500 in penalty-free emergency accounts linked to retirement plans (source).

Research shows that when employers provide these options, participation in both emergency and retirement savings increases significantly (source).

4. Expenses: Controlling Cash Flow For Smart Money Management

Managing expenses is a cornerstone of financial stability. Expenses typically fall into two categories: essentials (e.g., rent, utilities, groceries) and discretionary spending (e.g., travel, entertainment). By controlling cash flow and avoiding overspending, individuals can allocate more funds toward savings and investments, ultimately building long-term wealth.

Budgeting Strategies Worldwide

- The 50/30/20 Rule: This popular budgeting framework helps allocate income efficiently:

- 50% for necessities: Rent, utilities, groceries, transportation.

- 30% for wants: Entertainment, dining out, vacations.

- 20% for savings or debt reduction: Emergency funds, retirement accounts, or paying off loans.

Families in India who follow this rule save an additional 15% annually compared to those who don’t budget effectively (source).

- Zero-Based Budgeting: Every dollar is assigned a purpose, ensuring no money is left unaccounted for. This method is particularly effective for individuals with fluctuating incomes or those looking to maximize savings (source).

- Envelope System: Popular in countries like the U.S. and Canada, this system involves allocating cash into envelopes for specific expenses (e.g., groceries, entertainment). Once an envelope is empty, spending in that category stops (source).

Cutting Costs to Boost Wealth

- Rentvesting in Australia: Rentvesting is a growing trend where individuals rent homes in desirable locations while investing in properties elsewhere. This strategy allows young adults to enter the housing market earlier—on average, five years sooner—while still enjoying urban living (source).

- Avoid Lifestyle Inflation: Lifestyle inflation occurs when people increase their spending as their income rises. A simple rule to combat this is saving at least 50% of any salary increase, which builds wealth up to three times faster—even with modest raises (source).

- Reduce Discretionary Spending: Small changes in discretionary expenses can lead to significant savings:

- Cutting back on dining out by $50 per week results in annual savings of $2,600.

- Switching to generic brands for groceries can save families up to $1,500 annually (source).

- Negotiate Fixed Costs: Renegotiating contracts for services like insurance, internet, or phone plans can lead to substantial savings. For example:

Technology and Expense Management

- Expense Tracking Apps:

Apps like Mint or YNAB (You Need A Budget) help users monitor spending habits and identify areas for improvement. Studies show that individuals who track their expenses reduce discretionary spending by an average of 18% (source). - Automated Bill Payments:

Automating recurring bills ensures timely payments and avoids late fees while simplifying cash flow management (source). - Digital Subscriptions Management:

Subscription services often go unnoticed in budgets. Tools like Truebill or Rocket Money help identify and cancel unused subscriptions, saving users hundreds annually (source).

5. Investments: Growing Your Wealth

Investing allows your money to grow and work for you, offering higher returns than traditional savings. By diversifying across stocks, real estate, and retirement accounts, you can build long-term wealth and achieve financial independence.

Global Investment Options

- Stock Markets:

Investing in stock markets offers the potential for significant long-term growth:- In the U.S., consistently investing $100 monthly in the S&P 500 from age 25 can grow to over $300,000 by age 65, assuming an average annual return of 7% (source).

- In Japan and Europe, value stocks are expected to outperform in 2025 as global interest rates stabilize. Japanese equities, particularly small- and mid-cap stocks, remain attractively valued after decades of economic stagnation (source).

- Real Estate:

Real estate is a cornerstone of wealth creation worldwide:- In Canada, homeownership accounts for 70% of generational wealth, making it a critical investment for families building long-term financial security (source).

- In Australia, homeowners’ net worth is eight times higher than renters’, driven by rising property values and government incentives for first-time buyers (source).

- Retirement Accounts:

Maximizing contributions to retirement accounts ensures steady growth over time:- In the U.S., tools like the 401(k) allow tax-deferred growth, with many employers offering matching contributions, significantly boosting retirement savings.

- In Australia, the Superannuation system is a mandatory savings plan that helps workers accumulate substantial funds for retirement (source).

Diversifying Investments

- Index Funds and ETFs:

Index funds and exchange-traded funds (ETFs) offer broad market exposure with lower fees compared to actively managed funds. These are ideal for long-term investors seeking steady returns without the need for constant monitoring (source). - Alternative Investments:

Private equity, venture capital, and real estate investment trusts (REITs) provide opportunities for higher returns:- REITs pool investor funds to purchase income-generating properties like commercial buildings or apartments.

- Private equity investments in emerging sectors such as AI and renewable energy are expected to thrive in 2025 due to technological advancements (source).

- Government Bonds and TIPS:

For risk-averse investors, government bonds offer stability:- Treasury Inflation-Protected Securities (TIPS) adjust their principal with inflation, providing a hedge against rising prices.

- Government bonds are considered “risk-free” investments backed by national governments (source).

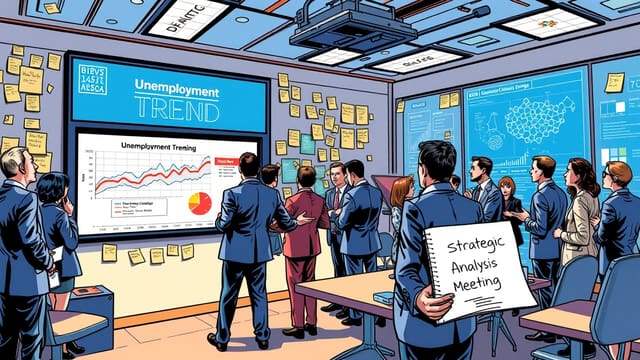

Key Trends in 2025

- AI and Technology Investments:

Companies specializing in artificial intelligence (AI) and automation are expected to drive market growth. Enterprise spending on AI is projected to grow at an annual rate of 84% over the next five years (source). - Sustainable Investing:

Renewable energy and ESG (Environmental, Social, Governance) investments are gaining traction as governments worldwide push for greener economies (source). - Global Market Opportunities:

While U.S. equities remain strong, international markets like Japan and Europe offer diversification opportunities due to undervalued stocks and improving economic conditions (source).

Building a Long-Term Investment Strategy

- Start Early:

The earlier you begin investing, the more time your money has to grow through compounding returns. Even small monthly contributions can lead to significant wealth over decades. - Diversify Across Asset Classes:

Spreading investments across stocks, bonds, real estate, and alternative assets reduces risk while maximizing potential returns. - Focus on Low-Cost Investments:

High fees can erode returns over time. Opt for low-cost index funds or ETFs to keep more of your earnings invested (source). - Rebalance Regularly:

Periodically adjust your portfolio to maintain your desired asset allocation as markets fluctuate.

Conclusion: The Ripple Effect of Financial Literacy

Managing income, debt, savings, expenses, and investments creates a powerful ripple effect that improves financial health, reduces stress, and builds a foundation for long-term wealth. Each element of financial literacy is interconnected, and even small, consistent actions can lead to significant results over time.

The Power of Small Actions

- Saving as little as $5 daily may seem insignificant, but when invested wisely, it can grow into substantial wealth due to the power of compounding. For example, investing $5 daily at a 7% annual return could grow to over $75,000 in 30 years.

- Simple habits like tracking expenses or automating savings can transform financial outcomes for individuals and families.

Financial Literacy Beyond Numbers

Financial literacy is not just about understanding numbers—it’s about creating stability, reducing financial anxiety, and building opportunities for future generations. It empowers individuals to:

- Make informed decisions about spending and saving.

- Break free from cycles of debt.

- Invest in assets that grow wealth over time.

A Legacy for Future Generations

By mastering personal finance, individuals can pass on knowledge and resources to their children, fostering generational wealth. Teaching children early about budgeting, saving, and investing ensures they are equipped to make sound financial decisions in adulthood.

Takeaways

- Start small: Begin with manageable steps like saving a few dollars daily or paying off minor debts.

- Stay consistent: Regular contributions to savings or investments build momentum over time.

- Educate yourself: Financial literacy is an ongoing journey that pays lifelong dividends. By focusing on these principles, you can create a ripple effect that not only secures your financial future but also positively impacts those around you. Financial literacy is the key to stability and prosperity for generations to come.

How to budget money on low income

Budget money on low income requires adaptability, discipline, and resourcefulness.