Consumer Spending Swings: Goods Down, Services Up—What Gives?

Here’s the deal: consumer spending is doing a wild dance in 2025. The U.S. Bureau of Economic Analysis (BEA) dropped some eye-opening stats In January, Americans spent $76.6 billion less on goods—like that shiny new TV—while pumping $46.2 billion more into services, like gym memberships or Netflix binges, per the U.S. Bureau of Economic Analysis. We’re ditching stuff for experiences. Why? And what’s it mean for your wallet? Let’s peel back the chaos and find the order—because your money deserves a plan, not a panic.

The Big Pivot: From Stuff to Stories

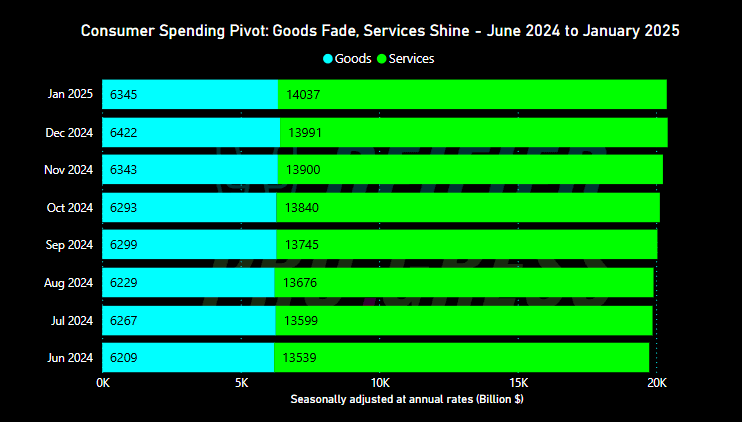

The numbers don’t lie. Goods spending dropped from $6,421.7 billion in December 2024 to $6,345.1 billion in January 2025—a 1.2% slide. Meanwhile, services climbed from $13,990.8 billion to $14,036.7 billion—a 0.3% bump. Durable goods (think cars) tanked 3%, but services held steady. We’re not buying couches; we’re buying yoga classes. What’s driving this flip, and should you care? Spoiler: Yes, you should.

Why Consumer Spending Is Ditching Goods for Services

Let’s break it down—three big reasons we’re swapping shopping carts for service subscriptions:

1. Inflation Punches Goods Harder

Goods prices are still stinging from 2.6% inflation (core PCE). That $2,000 fridge now costs $2,052—ouch. Services? Less volatile. “Inflation hits stuff you can touch more than stuff you feel,” says financial advisor Jane Smith. No wonder we’re skipping the checkout line.

2. Post-Pandemic Vibes: We Crave Experiences

After 2020’s lockdown blues, we’re done hoarding toilet paper. X posts scream it: “I’d rather travel than buy another gadget.” Preferences shifted—experiences beat possessions. Call it the YOLO effect, minus the recklessness.

3. The Service Economy’s Booming

Jobs in services—like healthcare and tech—grew 0.4% in January . More income from services means more spending there. It’s a feedback loop. Goods-producing industries? Flatlined. The world’s tilting, and our wallets are too.

Charting the Shift: See the Spending Swing

Data: U.S. Bureau of Economic Analysis (BEA), Jan 2025. Visual by Deified Progress

What This Means for Industries—and You

This consumer spending shift isn’t just trivia; it’s a seismic ripple:

- Goods Makers Hurt: Retail and manufacturing take a hit—think fewer factory jobs if cars and couches stay unsold.

- Services Win: Gyms, streaming, and travel soar. Service jobs might grow, but expect higher prices if demand spikes.

- Your Wallet: Goods get cheaper (sales!), but services could cost more. Balance matters—don’t get caught flat-footed.

Peterson might say, “Chaos in markets is a call to order your finances.” He’s not wrong.

Consumer Spending Hacks: 3 Tips to Thrive in the Shift

Adapt or flounder—here’s how to keep your money sharp:

- Budget for Services: Allocate 10-15% more for experiences—dinners, classes, trips. Need help? How to Budget Money on Low Income – 11 Amazing Ideas has tricks to stretch every buck.

- Find Value in Experiences: Skip overpriced concerts; hunt deals on local events. Quality beats quantity—your soul will thank you.

- Adjust to Markets: Buy goods on discount now, save for pricier services later. Want more? 5 Smart Money Management Strategies for Building Lasting Wealth ties it all together.

New to this game? How to Get Ahead Financially: 7 Research-Based Solid Workable Strategies for 2025 is your roadmap to winning, whatever the market throws.

Your Questions, Answered

Q: Is consumer spending on goods dead?

No—just napping. Discounts might wake it up, but services are the star now.

Q: How do I save with this shift?

Cut goods you don’t need; prioritize services you love. Emergency Fund Savings Trends in 2025 shows how savings still fit.

Wrap-Up: Your Wallet, Your Move

The consumer spending swing—less on goods, more on services—isn’t random. Inflation, preferences, and a service-driven world are rewriting the rules. It’s not about stuff anymore; it’s about stories. Adjust your budget, snag deals, and plan ahead—because chaos doesn’t care, but you should. Want long-term security? Peek at When to Start Thinking About Retirement Savings in the USA: A Step-by-Step Guide 2025 to keep the big picture in sight.

Sources

U.S. Bureau of Economic Analysis. (2025, February). Personal income and its disposition, seasonally adjusted [Data table]. U.S. Department of Commerce. Retrieved March 5, 2025, from Personal Income and Outlays, January 2025 | U.S. Bureau of Economic Analysis (BEA)