USA Canada Mineral Trade: 5 Shocking Impacts on EVs in 2025

The USA Canada mineral trade is a cornerstone of the global economy, especially as demand for electric vehicles (EVs) and advanced automotive technologies soars. Minerals like cobalt, lithium, palladium, and platinum are key players in this landscape, driving innovation in batteries and emissions control. From 2018 to 2024, production trends for these minerals have shifted, influenced by geography, capacity, and recent tariff disputes. This article explores how these changes impact the EV and automotive industries, revealing five surprising effects you need to know about in 2025.

Understanding Cobalt and Lithium in USA Canada Mineral Trade

What Are Cobalt and Lithium?

Cobalt and lithium are critical minerals essential for modern technology. Cobalt is a hard, lustrous metal that stabilizes lithium-ion batteries, while lithium is a lightweight element that boosts energy storage. Together, they power EV batteries and support renewable energy systems, making them vital for the green revolution.

Cobalt and Lithium Production Trends (2018–2024)

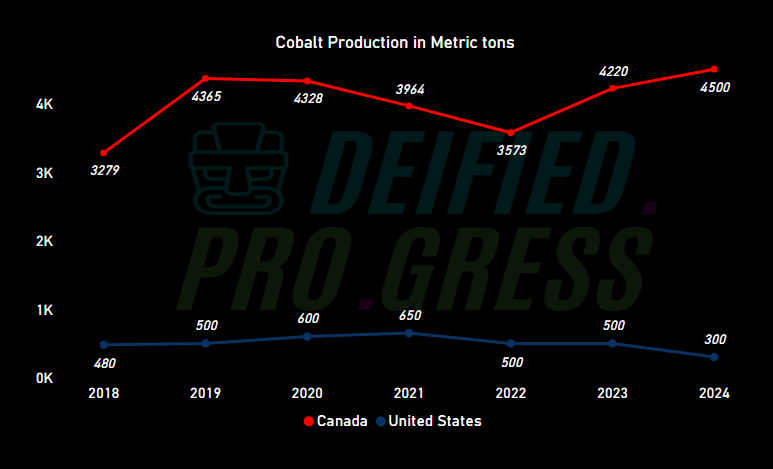

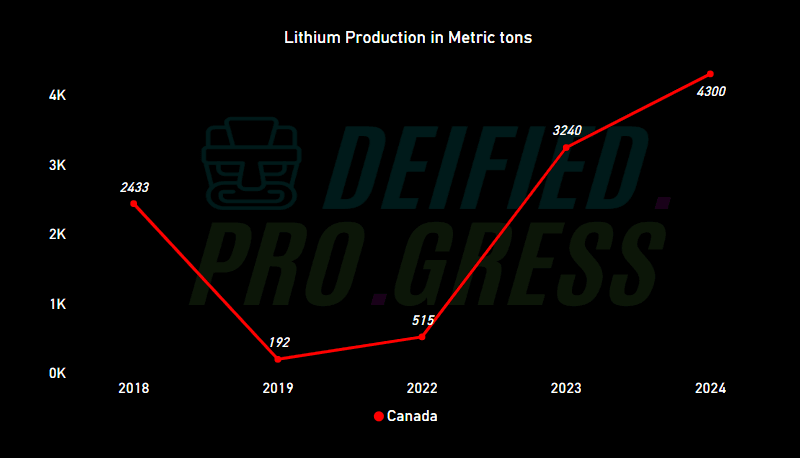

Production of cobalt and lithium has varied across the USA and Canada. In Canada, cobalt production peaked at 4,500 metric tons in 2024, while the USA produced just 300 metric tons. For lithium, Canada’s output rose from 2,433 metric tons in 2018 to 4,300 metric tons in 2024, with the USA showing minimal production. These trends highlight Canada’s growing dominance in USA Canada mineral trade.

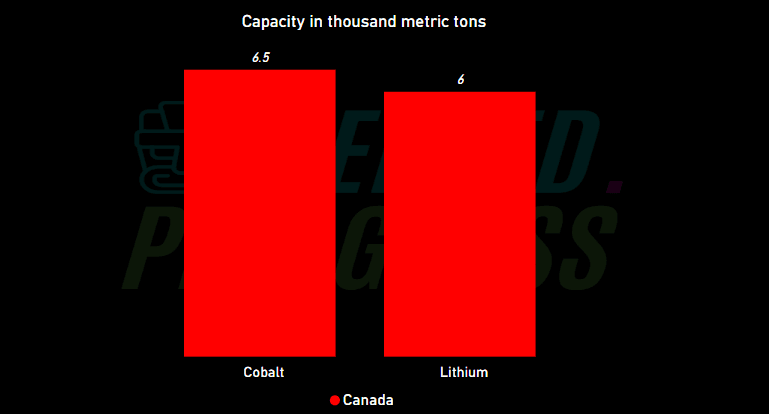

Capacity of Cobalt and Lithium in 2024

Canada’s capacity for these minerals is impressive. In 2024, cobalt capacity reached 6.5 thousand metric tons, and lithium capacity hit 6 thousand metric tons. This capacity signals Canada’s potential to meet future demand, a key factor in USA Canada mineral trade dynamics.

Palladium and Platinum in USA Canada Mineral Trade

What Are Palladium and Platinum?

Palladium and platinum are precious metals critical to the automotive industry. They’re used in catalytic converters to reduce vehicle emissions. As traditional cars remain prevalent, these minerals ensure cleaner air, but their role may evolve as the industry shifts toward EVs.

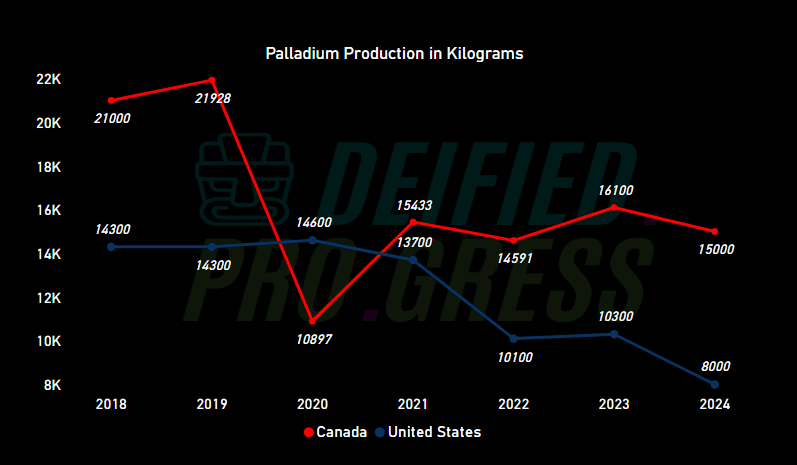

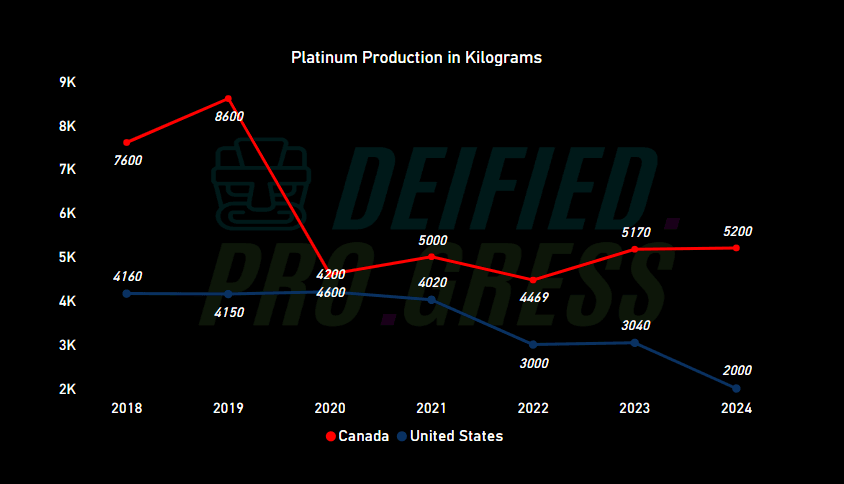

Palladium and Platinum Production Trends (2018–2024)

Palladium production in Canada peaked at 21,928 kilograms in 2019 but stabilized at 15,000 kilograms by 2024, while the USA produced 8,000 kilograms. Platinum production in Canada reached 5,200 kilograms in 2024, compared to 2,000 kilograms in the USA. These figures reflect the competitive nature of USA Canada mineral trade.

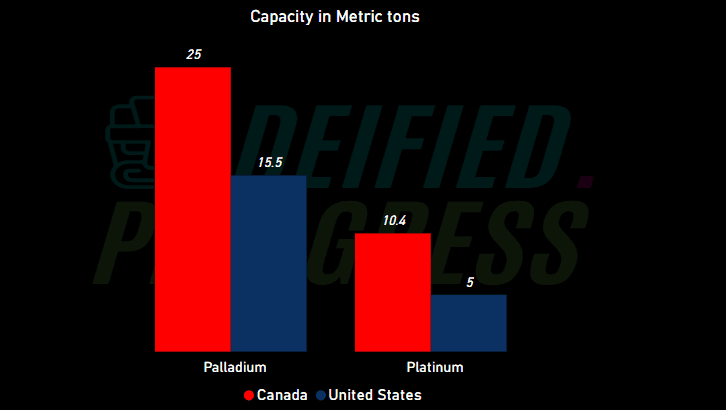

Capacity of Palladium and Platinum in 2024

In 2024, Canada’s palladium capacity stood at 25 metric tons, compared to 15.5 metric tons in the USA. For platinum, Canada’s capacity was 10.4 metric tons, while the USA’s was 5 metric tons. These capacities underscore Canada’s edge in USA Canada mineral trade.

The Role of Minerals in EVs and Automotive Industries

How Cobalt and Lithium Power EV Batteries

Cobalt and lithium are the backbone of EV batteries. Cobalt enhances battery stability, preventing overheating, while lithium provides high energy density for longer ranges. As the EV market grows, these minerals are in hot demand, driving innovation in USA Canada mineral trade.

- Energy Density: Lithium-ion batteries store more power, boosting EV range.

- Stability: Cobalt reduces fire risks in batteries.

- Sustainability: Both support the shift to green transportation.

Palladium and Platinum in Catalytic Converters

Palladium and platinum are essential for catalytic converters in traditional vehicles. They convert harmful gases into less toxic substances, improving air quality. However, as EVs gain traction, demand for these metals may decline, affecting their role in USA Canada mineral trade.

Impact of USA Canada Tariff War on Mineral Trade

What Is the USA Canada Tariff War?

The USA Canada tariff war involves recent trade disputes, with the USA imposing tariffs on Canadian minerals to boost domestic production. This conflict, starting in 2023, has disrupted the flow of cobalt, lithium, palladium, and platinum across the border.

How Tariffs Affect Cobalt and Lithium Trade

Tariffs have raised the price of cobalt and lithium imports, increasing EV production costs. Supply chain delays have also hit manufacturers, slowing EV rollout. This tension in USA Canada mineral trade could push companies to seek alternative sources.

Tariffs and Palladium-Platinum Trade

For palladium and platinum, tariffs have increased costs for catalytic converter production. The automotive industry faces higher expenses, potentially raising vehicle prices. This shift in USA Canada mineral trade highlights the need for stable trade agreements.

Key Questions About USA Canada Mineral Trade

Where Are These Minerals Found in the USA and Canada?

Cobalt and lithium deposits are rich in Canada’s Ontario and Quebec regions, while the USA mines lithium in Nevada. Palladium and platinum are abundant in Canada’s Sudbury Basin and the USA’s Stillwater Complex, shaping USA Canada mineral trade patterns.

What Are the Prices of These Minerals in 2024?

In 2024, cobalt prices range from $30,000 to $40,000 per ton, while lithium hovers around $15,000 per ton. Palladium and platinum prices fluctuate, with palladium at approximately $1,000 per ounce and platinum at $900 per ounce, influencing USA Canada mineral trade economics.

What Does the Future Hold for USA Canada Mineral Trade?

Looking to 2025–2029, capacity trends suggest Canada will expand lithium and cobalt production to meet EV demand. Palladium and platinum may see steady growth unless EV adoption accelerates, reshaping USA Canada mineral trade dynamics.

Conclusion

The USA Canada mineral trade is crucial for the EV and automotive industries, with cobalt, lithium, palladium, and platinum driving innovation. Previous tariff wars has introduced five shocking impacts: higher costs, supply delays, price volatility, industry shifts, and a push for domestic production. Stay informed about these changes and their effects on mineral markets by following updates from trusted sources like the U.S. Geological Survey (data from Alonso et al., 2025, https://doi.org/10.5066/P1HTTCWN).