How much Ciders are Canadians drinking? 7 Astonishing Facts About Booming National Beverage

How much Ciders are Canadians drinking?

The Canadian refreshment beverage market—comprising ciders, coolers, and similar ready-to-drink options—has undergone a remarkable transformation over the past two decades. What was once a modest industry segment has evolved into a powerhouse within Canada’s beverage landscape, reflecting changing consumer preferences, demographic shifts, and economic factors that have reshaped drinking habits across the country.

This analysis dives deep into comprehensive data spanning from 2005 to 2024, revealing not just consumption patterns but the underlying economic and cultural forces driving Canada’s thirst for these increasingly popular beverages. Through examining consumption volumes, regional differences, market growth, and revenue trends, we can better understand how this market has evolved and what it means for different stakeholders in the industry.

Table of Contents

The Steady Climb: Consumption Trends Since 2005

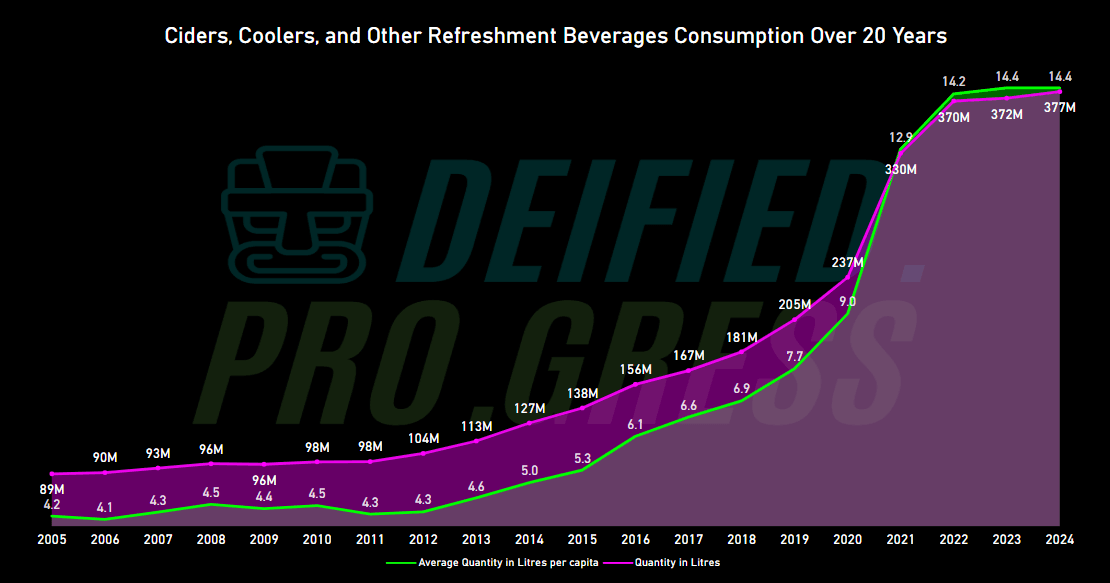

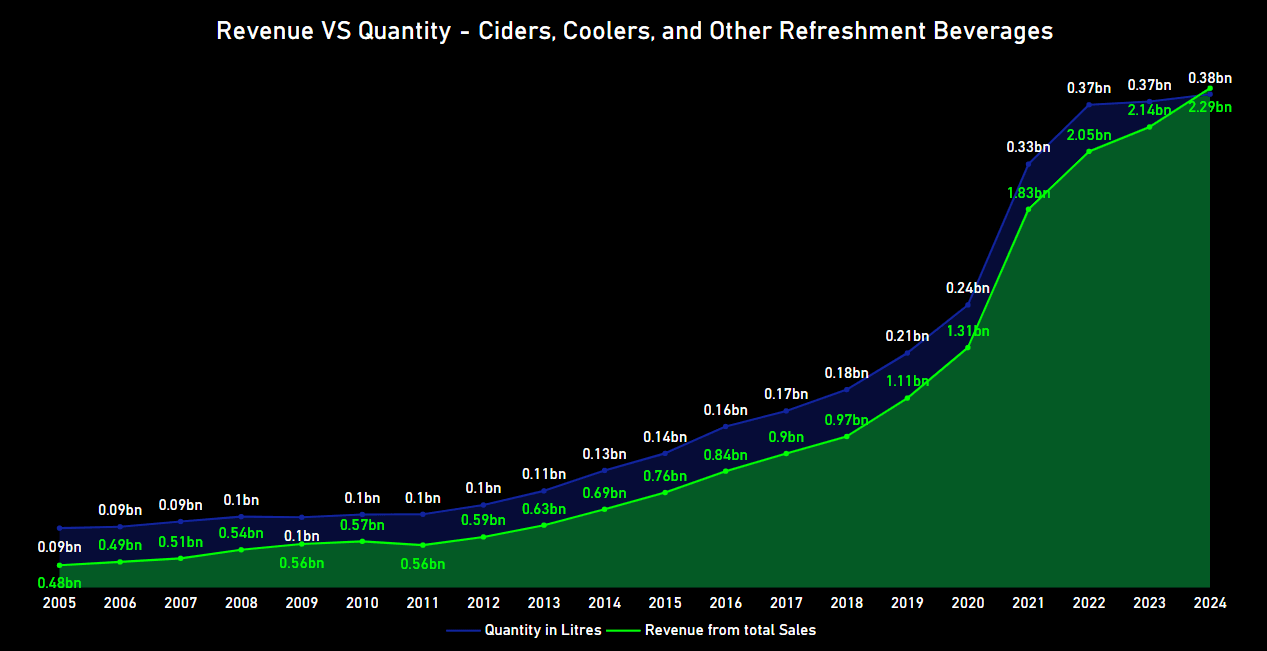

The most striking observation from the data is the extraordinary growth trajectory. In 2005, total consumption stood at a modest 89 million liters, with Canadians consuming an average of just 4.2 liters per capita annually. Fast forward to 2024, and these figures have skyrocketed to 377 million liters, with per capita consumption reaching 14.4 liters—more than tripling over twenty years.

This growth wasn’t simply linear. The data reveals three distinct phases:

- Steady State (2005-2012): During this initial period, growth was minimal, with consumption hovering around 90-100 million liters annually and per capita consumption remaining relatively stable between 4.1-4.6 liters.

- Acceleration Phase (2013-2019): Beginning around 2013, the market began to gain momentum. Year-over-year increases became more substantial, with total consumption rising from 113 million liters in 2013 to 237 million liters by 2019.

- Explosion Period (2020-2024): The most dramatic growth occurred in recent years, particularly following 2020, when consumption surged from 237 million to 350 million liters in just two years, eventually reaching 377 million liters by 2024.

For the Canadian consumer, this translates to a noticeable shift in both availability and variety of products. Where once store shelves might have featured a handful of traditional cider options, today’s consumer faces an abundant selection of flavored ciders, alcoholic seltzers, ready-to-drink cocktails, and innovative cooler products.

The average Canadian now consumes more than three times the volume of these beverages compared to 2005—equivalent to about 43 standard 330ml cans annually, up from just 13 cans in 2005. This increase reflects not just greater consumption among existing drinkers but likely indicates a broadening consumer base as these products have gained mainstream appeal.

The COVID Effect: Pandemic’s Impact on Consumption

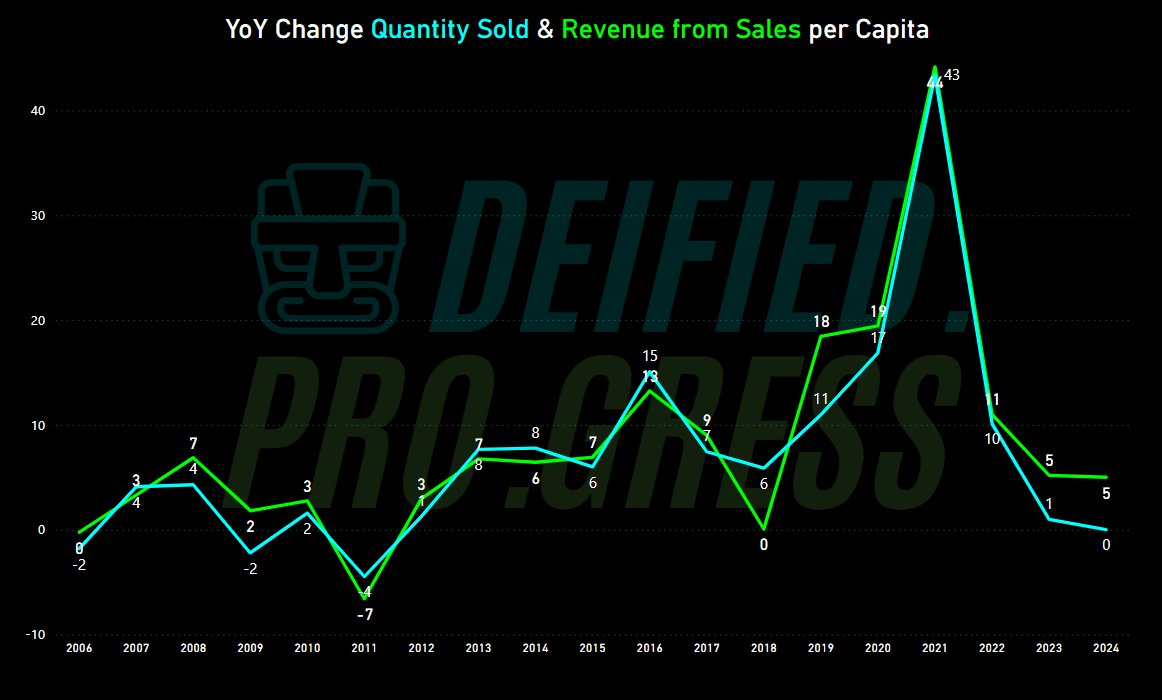

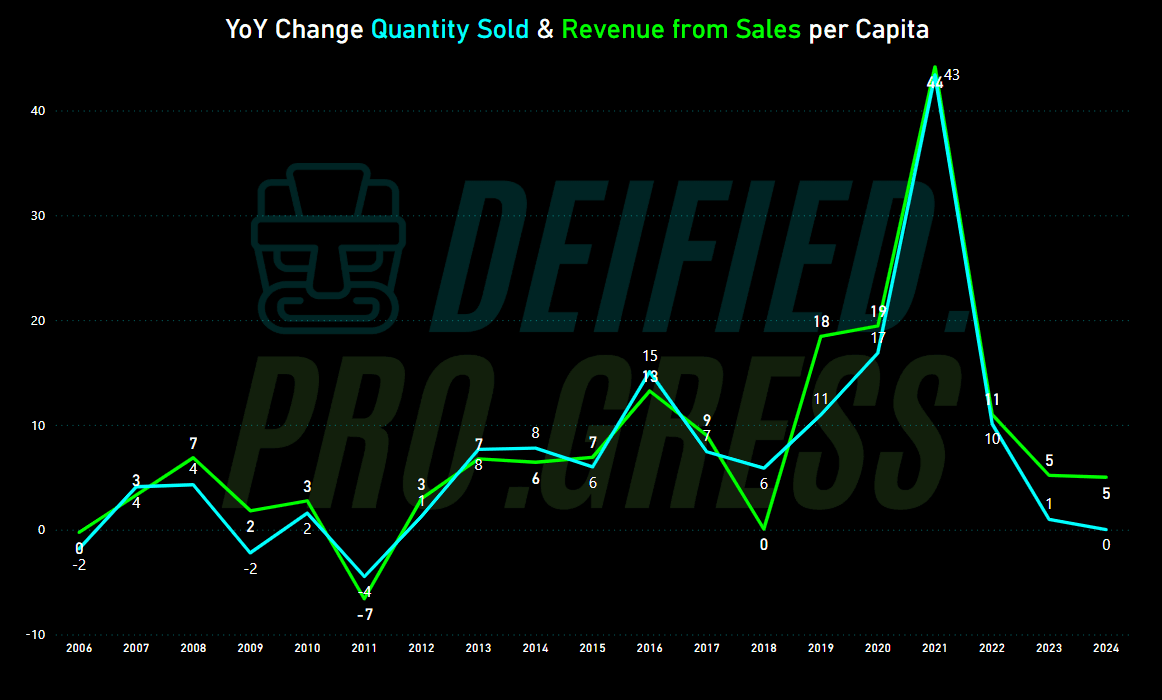

Perhaps the most dramatic feature in the data is the extraordinary spike in both consumption and revenue during 2020-2021. The year-over-year change visualization reveals a staggering 43% increase in quantity sold during 2021—by far the largest single-year growth in the entire dataset.

This pandemic-era surge deserves particular attention, as it represents more than just an acceleration of existing trends. Multiple factors likely contributed:

- On-premise to Off-premise Shift: With bars and restaurants closed or restricted, consumer drinking shifted heavily to at-home consumption, where ready-to-drink beverages offer convenience.

- Comfort Consumption: During periods of stress and uncertainty, consumers often gravitate toward affordable indulgences.

- Health Consciousness: Many cider and seltzer products position themselves as “healthier” alternatives to traditional alcohol options, appealing to pandemic-era health concerns.

- E-commerce Acceleration: The rapid expansion of alcohol delivery services and online ordering made these products more accessible than ever before.

Interestingly, while the quantity spike was dramatic, it wasn’t merely a temporary anomaly—the market largely maintained its elevated consumption levels post-pandemic, even as growth rates normalized. This suggests the pandemic created lasting changes in consumer behavior rather than just a temporary surge.

The pandemic-era growth represents a fascinating case study in market disruption and adaptation. While many industries suffered devastating losses during this period, the ready-to-drink beverage category experienced unprecedented growth—demonstrating remarkable resilience and even benefiting from the changed consumption landscape.

The economic implications extend beyond simple volume increases. The revenue growth outpaced volume growth during this period, indicating price premiumization—consumers were willing to pay more per unit, perhaps as a substitute for money they would have spent in bars and restaurants.

Regional Disparities: A Tale of Different Tastes

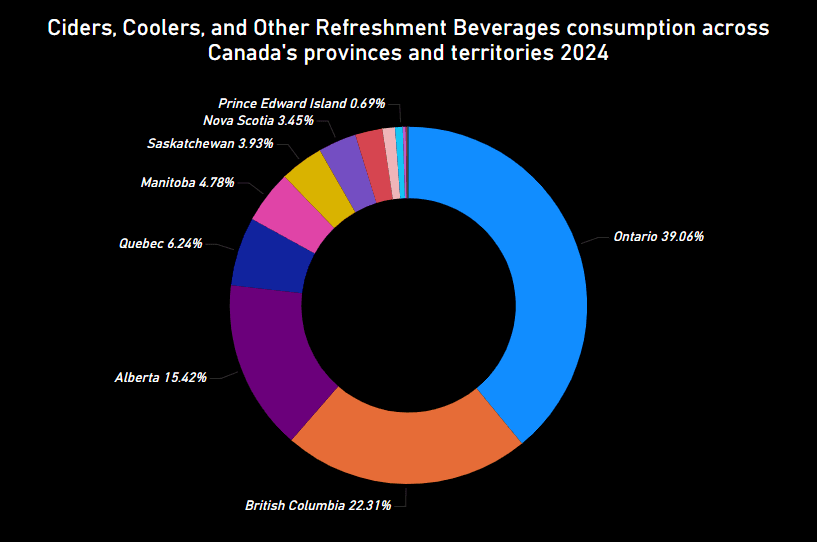

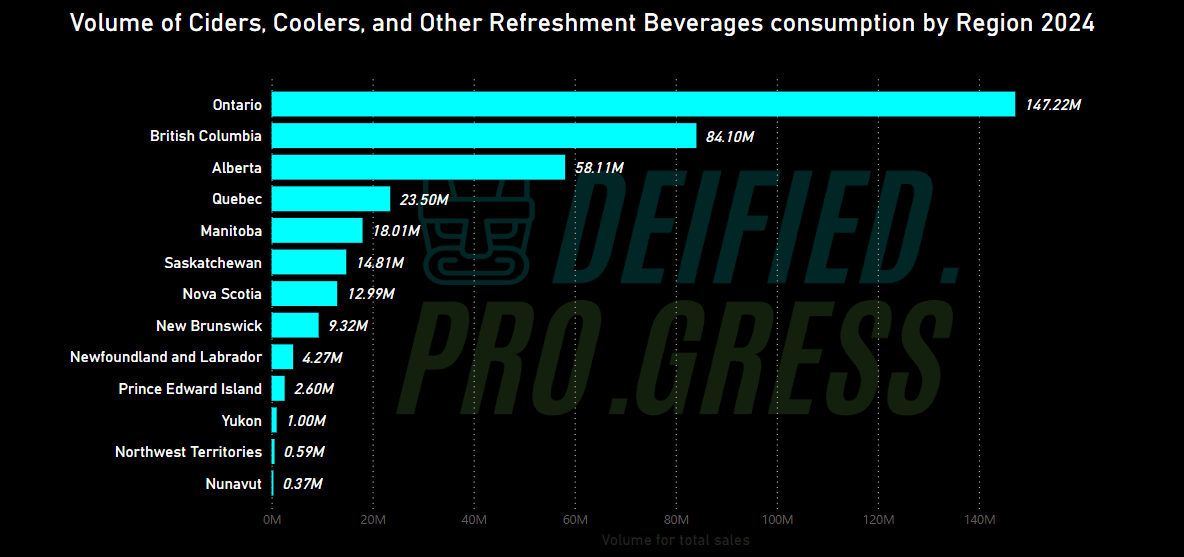

One of the most fascinating aspects of the data is the stark regional variation in consumption patterns across Canada’s provinces and territories. The provincial breakdown reveals that Ontario dominates overall consumption, accounting for a substantial 39.06% of the national total, followed by British Columbia (22.31%) and Alberta (15.42%).

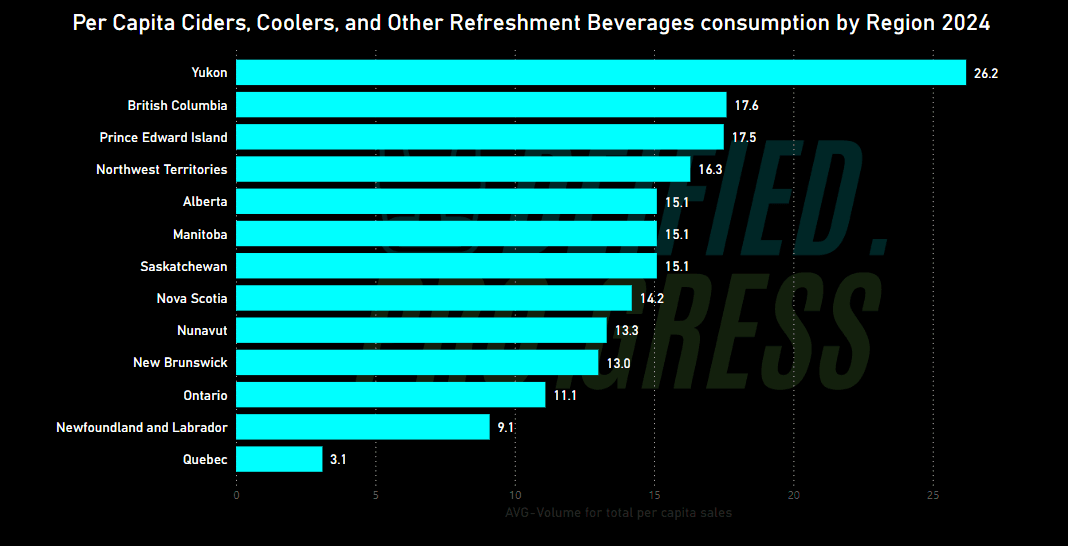

However, when examining per capita consumption, a dramatically different picture emerges. Yukon leads the nation with an astonishing 26.2 liters per person annually—more than twice the national average. British Columbia and Prince Edward Island follow with 17.6 and 17.5 liters per capita, respectively.

Most striking is Quebec’s position in these comparisons. Despite ranking fourth in total volume (23.50 million liters) and contributing 6.24% to national consumption, Quebec has by far the lowest per capita consumption at just 3.1 liters—less than a quarter of the national average.

These disparities reflect complex regional factors:

- Regulatory Environments: Provincial liquor laws and distribution systems significantly impact product availability and pricing.

- Cultural Preferences: Quebec’s strong wine culture and Alberta’s beer traditions influence regional drinking habits.

- Demographics: Territories like Yukon, with younger populations and higher disposable incomes, show stronger preference for these beverages.

- Tourism Impact: Regions with significant tourism (BC, PEI) show elevated consumption, partly reflecting visitor purchasing.

These regional disparities present both challenges and opportunities. Taxation strategies, public health initiatives, and economic development plans must consider these pronounced regional differences in consumption patterns.

Quebec’s remarkably low per capita consumption (despite being a major population center) suggests potential market growth opportunities through regulatory adjustment or targeted marketing. Conversely, the extraordinarily high consumption in Yukon might warrant attention from public health perspectives.

The data also reveals how provincial economic policies can influence beverage markets. Provinces with more liberalized retail models generally show higher consumption rates, while those with more restrictive systems (like Quebec with its emphasis on wine) show lower adoption of these ready-to-drink options.

Price Points and Premiumization: The Revenue Story

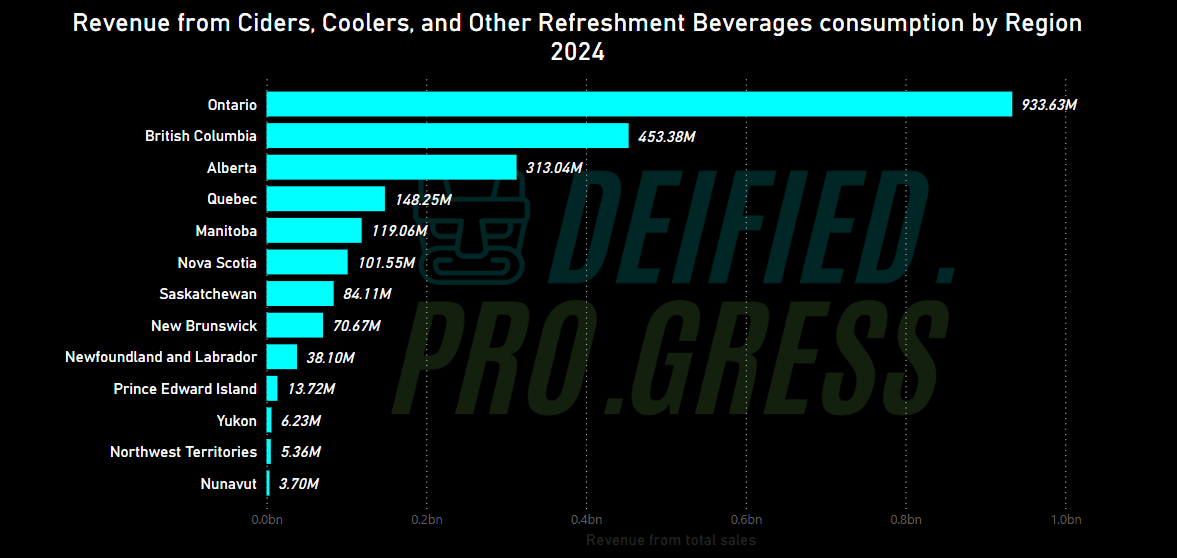

Perhaps the most economically significant trend in the data is the remarkable revenue growth that has accompanied increased consumption. Total revenue from ciders, coolers, and refreshment beverages has skyrocketed from approximately $0.48 billion in 2005 to $2.29 billion by 2024—a nearly 380% increase.

What’s particularly notable is that revenue growth has consistently outpaced volume growth, especially in recent years. This indicates significant premiumization within the category—consumers are not just buying more products but paying more per unit.

The provincial revenue breakdown reveals Ontario generating $933.63 million in sales, followed by British Columbia ($453.39M) and Alberta ($313.04M). These figures largely align with volume distribution, though some provinces show higher revenue-to-volume ratios, suggesting premium pricing or stronger preference for higher-end products.

The revenue versus quantity visualization illustrates how the gap between volume and value has widened over time, particularly accelerating after 2018. By 2024, while volume had grown to about 4.2 times its 2005 level, revenue had grown nearly 4.8 times—evidence of successful category premiumization.

For industry stakeholders, this premiumization trend presents compelling opportunities. The data suggests consumers have increasingly accepted higher price points for refreshment beverages, likely driven by:

- Craft and Premium Positioning: Many new entrants have positioned themselves as craft or premium products, commanding higher prices.

- Innovation Premium: Novel flavors, ingredients, and packaging innovations have justified price increases.

- Health and Wellness Positioning: Products marketed as “better for you” (organic, low-calorie, natural) typically command premium prices.

- Shifting Demographics: The core consumer base has evolved from price-sensitive young adults to include more affluent consumers willing to pay for quality and convenience.

The Pandemic Pivot: Year-Over-Year Changes

Examining year-over-year changes provides crucial context for understanding market dynamics, particularly during tumultuous periods like the pandemic. The national data shows fairly modest growth (typically 5-10% annually) throughout most of the 2010s, before the extraordinary pandemic-era spike of 43% in 2021.

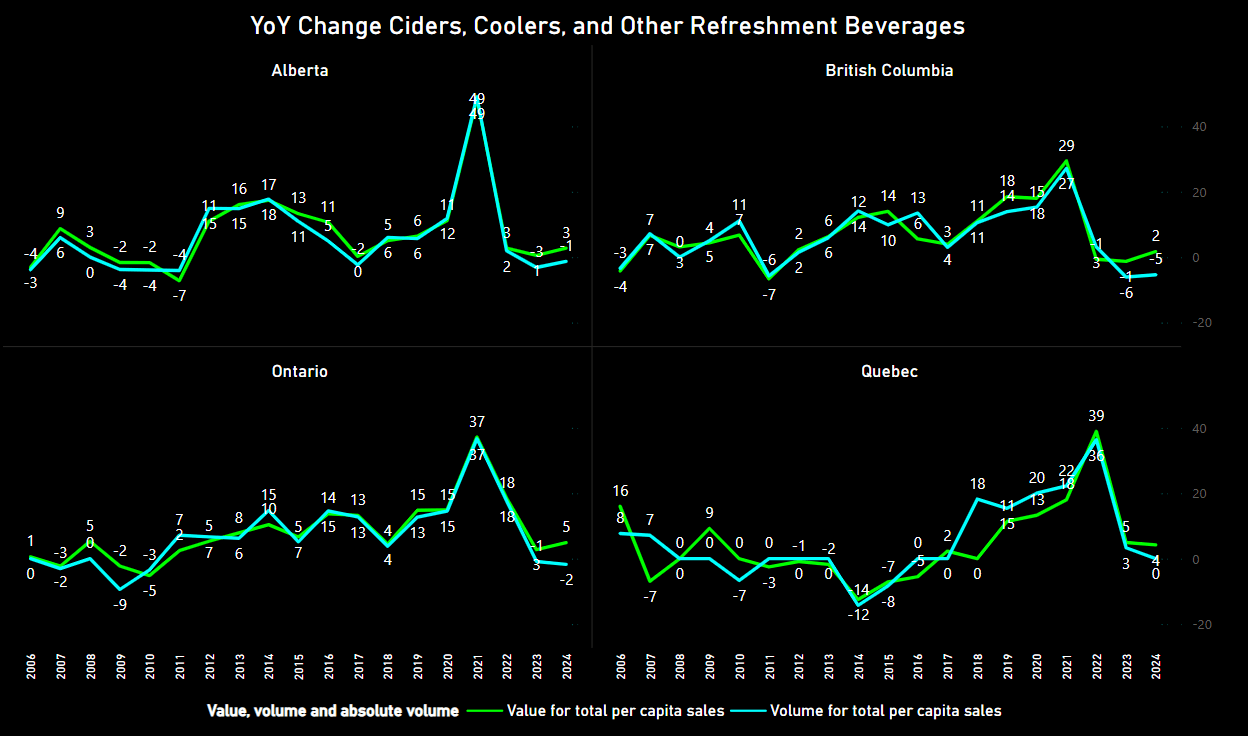

What’s particularly interesting is the provincial variation in pandemic response. All four major provinces (Ontario, Quebec, British Columbia, and Alberta) experienced dramatic growth during this period, but with different timing and intensity:

- Alberta saw its peak growth (49%) in 2021, following relatively modest growth in 2020.

- British Columbia experienced strong but more distributed growth across 2020-2021, reaching 29% at its peak.

- Ontario followed a similar pattern to Alberta, with its most dramatic growth (37%) occurring in 2021.

- Quebec saw the most extreme swing, with a remarkable 39% growth in 2021 (despite having the lowest per capita consumption overall).

These provincial differences likely reflect varying pandemic restrictions, lockdown timelines, and regulatory responses. Provinces with more severe or longer-lasting restrictions generally saw more dramatic shifts to at-home consumption.

The post-pandemic period (2022-2024) shows a significant correction, with growth returning to more modest single-digit rates across all provinces. Importantly, however, the market has maintained its elevated baseline rather than contracting—suggesting the pandemic created a permanent shift in consumption patterns rather than just a temporary surge.

From a public health standpoint, these consumption patterns raise important considerations. The pandemic-era surge likely represents not just a shift in where people consumed alcohol (from on-premise to off-premise) but potentially an overall increase in alcohol consumption during a period of heightened stress and isolation.

The maintained elevation of consumption post-pandemic may indicate lasting behavioral changes that warrant attention from health authorities. At the same time, the shift toward ready-to-drink beverages (which typically have clearly defined alcohol content and portion sizes) may have positive implications for responsible consumption compared to spirits or self-mixed drinks.

The Efficiency Factor: Absolute Quantity vs. Per Capita

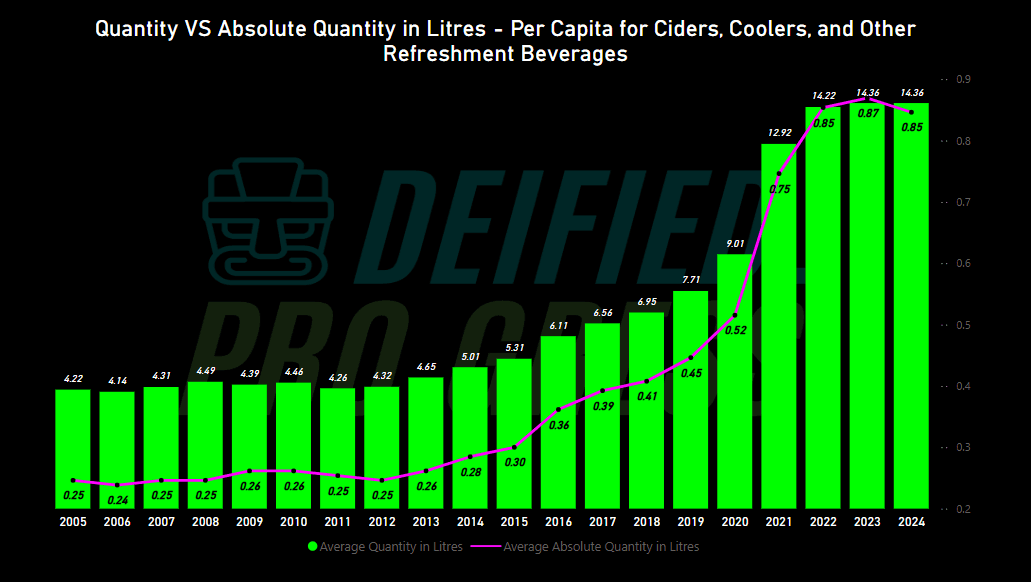

One of the more technical yet revealing visualizations examines the relationship between average quantity in liters and “absolute quantity”—a measure of consumption efficiency. This metric shows a fascinating evolution in how these products are consumed and packaged.

From 2005 through 2012, the absolute quantity remained remarkably stable at around 0.25 liters per serving, despite modest fluctuations in overall consumption. This suggests standardized packaging and serving sizes dominated the market during this period.

Beginning around 2013, however, the absolute quantity began a steady climb, accelerating dramatically after 2018 to reach 0.85 liters by 2024—more than tripling the average serving size. This indicates fundamental changes in how these beverages are packaged and consumed:

- Larger Format Packaging: A shift from individual serving sizes to larger format options (4-packs, 6-packs, variety packs).

- Bulk Purchasing Behavior: Consumers increasingly buying in bulk rather than single units.

- Product Format Evolution: Growth in larger volume products like canned cocktails versus smaller traditional coolers.

This trend parallels the overall market growth but represents a distinct dimension of market evolution—not just more product being consumed, but changing consumption patterns and packaging preferences.

For product developers and packaging innovators, this data suggests several strategic directions:

- Variety Pack Opportunity: The growth in absolute quantity aligns with the rise of variety packs, allowing consumers to try multiple flavors in larger overall purchases.

- Occasion-Based Packaging: Different size formats for different consumption occasions (individual cans for casual consumption, larger formats for social gatherings).

- Value Proposition: Larger formats generally offer better value per milliliter, appealing to increasingly value-conscious consumers.

- Sustainability Considerations: Larger formats typically use less packaging material per volume, potentially offering sustainability advantages that resonate with environmentally conscious consumers.

Conclusion: A Market Still Evolving

The two-decade evolution of Canada’s cider, cooler, and refreshment beverage market reflects broader societal shifts—changing drinking preferences, demographic evolution, premiumization trends, and pandemic-driven behavioral changes. What emerges is a picture of a market that has not just grown but fundamentally transformed.

Several key takeaways stand out:

- Sustained Growth: Despite periodic fluctuations, the overall trajectory shows remarkable sustained growth, with the market more than quadrupling over twenty years.

- Regional Complexity: The pronounced provincial variations highlight how local factors—regulation, culture, demographics—profoundly influence consumption patterns.

- Premiumization Success: The category has successfully elevated its price positioning, with revenue growth consistently outpacing volume growth.

- Pandemic Acceleration: COVID-19 didn’t create new trends so much as dramatically accelerate existing ones, compressing years of expected growth into months.

- Format Evolution: Changes in packaging and serving sizes reflect evolving consumer preferences for convenience, variety, and value.

Looking ahead, the steady growth seen in 2023-2024 suggests the market has found a new equilibrium after the pandemic disruption—still growing, but at a more sustainable pace. The regional disparities continue to present both challenges and opportunities, with significant untapped potential in lower-consumption provinces like Quebec.

For industry stakeholders, the data points to continued opportunities in premiumization, regional expansion, and format innovation. For policymakers, understanding these consumption patterns is essential for effective regulation and public health initiatives. And for consumers, the ever-expanding options in this category suggest the “rise of refreshment” still has new chapters to write.

As we look to the future, the question isn’t whether this market will continue to grow, but how it will evolve—which innovation directions, consumption occasions, and consumer segments will drive the next phase of this remarkable market transformation.

- How Much Beer Are Canadians Drinking in 2025?

- How Much Wine Are Canadians Drinking in 2025?

- How Much Spirit Are Canadians Drinking in 2025?

- How Much Alcohol Are Canadians Drinking in 2025?

Sources

Statistics Canada. Table 10-10-0010-01 Sales of alcoholic beverages types by liquor authorities and other retail outlets, by value, volume, and absolute volume