Personal Savings Rate Spikes: What’s Driving the January Jolt?

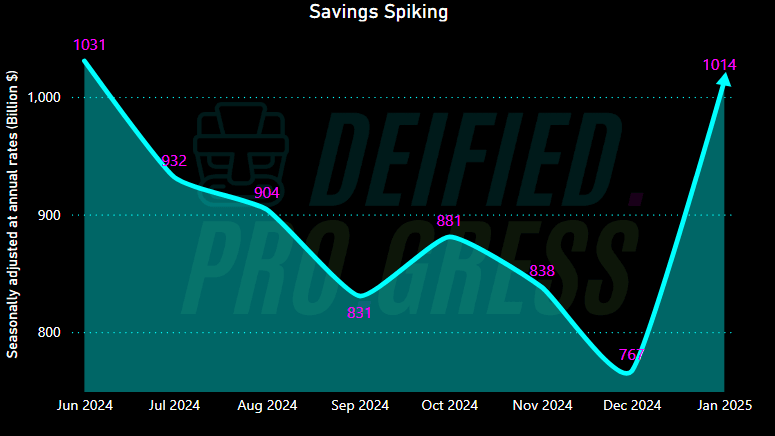

Here’s the kicker: the personal savings rate in the U.S. leapt to 4.6% in January 2025, up from 3.5% in December, according to the U.S. Bureau of Economic Analysis. That’s a headline worth shouting about—households socked away $1.01 trillion instead of splurging it. But why? Are we all just scared stiff of the future, or is something smarter at play? Let’s unpack this like a financial detective, because chaos doesn’t rule here—patterns do.

The Big Shift: From Spending to Saving

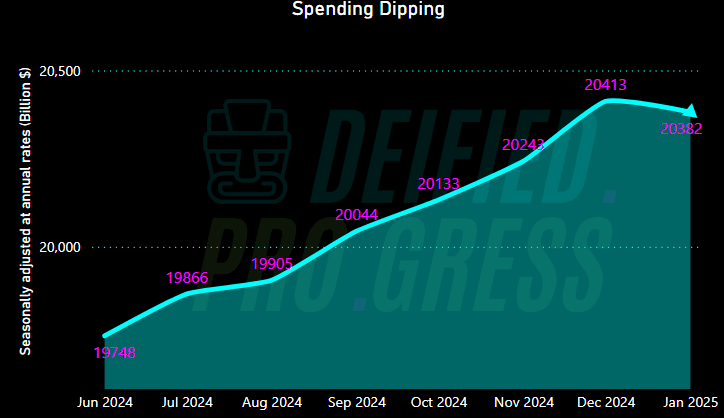

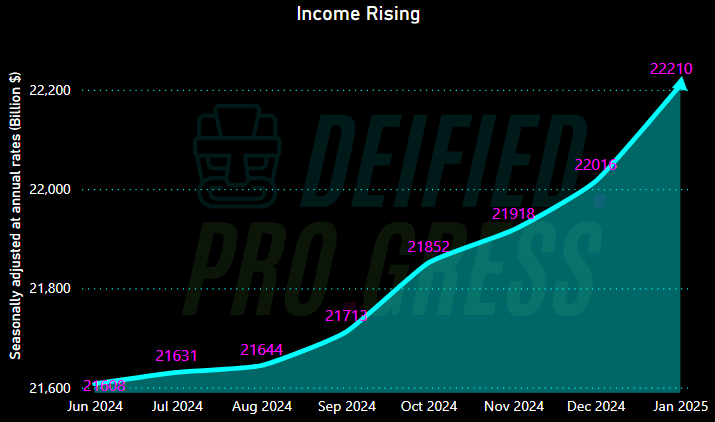

January hit like a cold shower after the holiday binge. Personal income climbed a hefty 0.9% ($221.9 billion), thanks to boosts in social security, wages, and dividends. Meanwhile, spending dropped $30.7 billion—especially on goods like that shiny new gadget you didn’t buy. The result? Disposable income surged, and Americans decided to stash it rather than flash it. The personal savings rate hasn’t been this high since June 2024. So, what flipped the switch?

Curious about that trend? Check out Down Payment Savings Trends in 2025 for the scoop on how folks are prepping for big buys in uncertain times.

Why Are We Hoarding Cash? 6 Key Drivers

Let’s cut through the noise and get to the meat of it. Here’s why Americans are suddenly playing defense with their wallets:

1. Trump’s Tariff Talk: Trade War Looms

Donald Trump’s back in 2025, and he’s swinging the tariff stick—25% on Canada and Mexico, 10% on China, maybe more. X posts buzz with fears of pricier groceries and cars if trade wars flare. Smart folks are saving now, expecting a wallet hit later. “Tariffs are a tax on you, not them,” warns advisor Mark Jones. Chaos looms—prepare accordingly.

2. Fear of the Economic Reaper

Recession whispers are everywhere. GDP growth might slow in 2025, and unemployment ticked up to 4.2% late last year. People aren’t dumb—they’re bracing for a storm, even if it’s just a drizzle. Financial advisor Jane Smith puts it bluntly: “When the future looks murky, you build a moat around your money.”

3. Inflation’s Sticky Fingers

Inflation’s down from its 2022 peak, but at 2.6% (core PCE), it’s still nibbling at purchasing power. Folks are saving more to fight back—because who wants to watch their dollar shrink like a cheap sweater?

4. Spending Fatigue Sets In

After years of YOLO spending, maybe we’re tired. Durable goods purchases—like cars and couches—plummeted in January. “Consumers are saying, ‘Enough’s enough,’” says advisor Mark Jones. Less retail therapy, more nest egg.

5. Income Windfalls Beg to Be Saved

Social security bumped up 2.8%, and wages crept higher. When extra cash lands in your lap, it’s tempting to hoard it—especially if you’re not sure it’ll keep coming.

6. A Smarter Money Mindset

Could it be… wisdom? Posts on X suggest caution’s trending. Maybe we’re finally learning that savings aren’t just for grandmas— they’re for survivors.

Visualizing the Trend: Where the Money’s Going

The January Jolt: Savings Surge as Spending Stalls.

Data: U.S. Bureau of Economic Analysis (BEA), Jan 2025. Visual by Deified Progress

How More Saving Shakes the Economy

More cash in savings accounts sounds like a win, but it’s a double-edged sword.

- The Upside: Stronger household balance sheets mean resilience. If a recession hits, we’re not all toast.

- The Downside: Less spending slows GDP growth. Businesses feel the pinch when you skip that new TV. Economists call it the “paradox of thrift”—saving too much can choke the system.

Balance matters. Saving’s a buffer, but tariffs could tank demand. It’s a tightrope. Want to plan for the long haul? When to Start Thinking About Retirement Savings in the USA: A Step-by-Step Guide 2025 breaks down how today’s savings shape tomorrow’s security.

Personal Savings Rate Hacks: 3 Tips to Ride the Wave

Saving’s trending—join in with these moves:

- Build an Emergency Fund: Aim for 3-6 months. See how others are doing it in Emergency Fund Savings Trends in 2025—it’s more popular than you think!

- Prioritize Goals: List them out. Need broader strategies? 5 Smart Money Management Strategies for Building Lasting Wealth has you covered with research-backed ideas.

- Trim Smart: Skip that $5 latte. On a tight budget? How to Budget Money on Low Income – 11 Amazing Ideas shows you how to stretch every dollar.

New to financial planning? Dive into How to Get Ahead Financially: 7 Research-Based Solid Workable Strategies for 2025 for a full playbook to level up.

Your Questions, Answered

Q: Is the personal savings rate increase a red flag?

Not necessarily. It’s caution, not panic—think preparation, not paranoia.

Q: How much should I save?

Start with 10% of your income. Adjust up if you smell trouble—or down if you’re debt-free and fearless.

Wrap-Up

The personal savings rate jumping to 4.6% isn’t just a stat—it’s a story. Fear, inflation, and a bit of good sense are turning spenders into savers. It’s not about hiding under the bed with your cash; it’s about standing tall when the winds blow. So, grab your piggy bank, folks—chaos looms, but you can be ready.

Sources

U.S. Bureau of Economic Analysis. (2025, February). Personal income and its disposition, seasonally adjusted [Data table]. U.S. Department of Commerce. Retrieved March 5, 2025, from Personal Income and Outlays, January 2025 | U.S. Bureau of Economic Analysis (BEA)