When to Start Thinking About Retirement Savings in the USA: A Step-by-Step Guide 2025

Planning for retirement is all about making sure you have enough money to live comfortably when you stop working. The earlier you start, the more time your savings have to grow, but even if you start later, smart planning can still help. This guide covers important steps, saving tips, and expert advice for Americans aged 25–65. Whether you’re just starting your career, in the middle of it, or getting close to retirement, you’ll learn how to grow your savings, manage debt, use Social Security wisely, and create a secure and stress-free future.

Table of Contents

Why Start Early? The Power of Compound Interest

- Example: Saving $500/month at age 25 with a 7% annual return grows to $1.4 million by 65. Wait until 35? You’ll have just $567,000 source: Edward Jones.

- Rule of 25: The Rule of 25 suggests saving 25 times your annual expenses for retirement. For example, if you need $60,000 per year, aim to save $1.5 million. This rule ensures you can withdraw about 4% of your savings each year, providing a sustainable income throughout retirement. It’s a helpful guideline to ensure you have enough to maintain your lifestyle without outliving your savings. source: Bankrate.

Key Retirement Milestones by Age

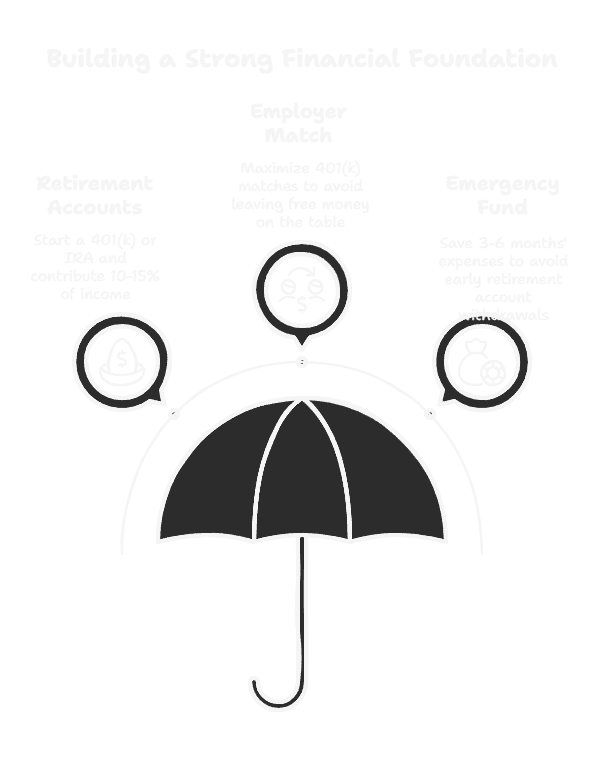

Ages 25–35: Build the Foundation

- Start a 401(k) or IRA: Contribute at least 10–15% of income.

- Employer Match: Never leave free money—maximize 401(k) matches (e.g., 3–6% of salary).

- Emergency Fund: Save 3–6 months’ expenses to avoid tapping retirement accounts early.

Stat: Only 45% of 35-year-olds have retirement savings source: Investopedia.

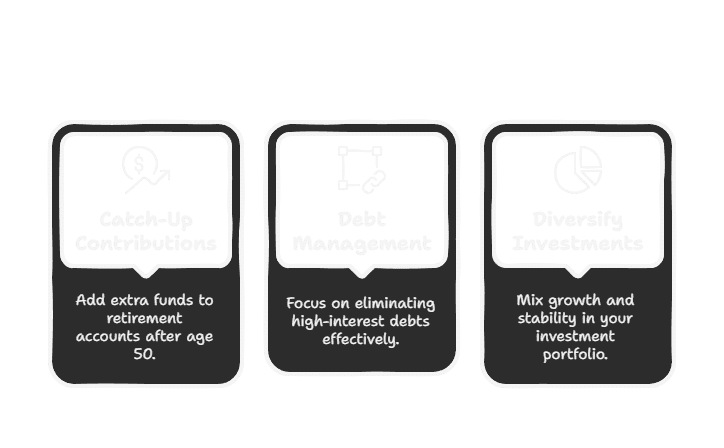

Ages 35–50: Accelerate Savings

- Catch-Up Contributions: At 50, add $7,500/year to 401(k)s and $1,000/year to IRAs source: IRS.

- Debt Management: Pay off high-interest debt (credit cards, loans).

- Diversify Investments: Balance stocks (growth) and bonds (stability).

Tip: Use Bankrate’s Retirement Calculator to track progress.

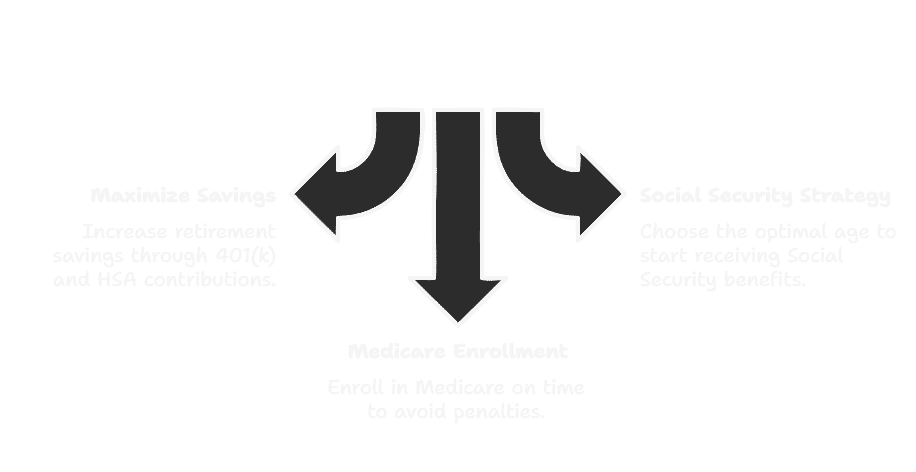

Ages 50–65: Finalize Your Plan

- Maximize Savings:

- 2025 Update: Workers aged 60–63 can contribute $11,250/year to 401(k)s (vs. $7,500 for others) source: Investopedia.

- Health Savings Account (HSA): Save $4,150/year (individual) for medical costs.

- Social Security Strategy:

- Early (62): Benefits reduced by 30% (e.g., $1,400/month vs. $2,000 at 67).

- Full Retirement Age (67): Receive 100% of benefits.

- Delay (70): Boost benefits by 24% source: SSA.

- Medicare at 65: Enroll 3 months before turning 65 to avoid penalties.

Top Challenges & Solutions

- Savings Shortfalls:

- Problem: 57% of Americans feel behind on retirement savings source: Bankrate.

- Fix: Use windfalls (tax refunds, bonuses) to boost savings.

- Healthcare Costs:

- Average Expense: $315k for a 65-year-old couple’s healthcare source: Fidelity.

- Fix: Pair Medicare with supplemental insurance.

- Inflation Risk:

- Impact: Rising costs shrink fixed incomes.

- Fix: Invest 20–30% in stocks for growth (e.g., S&P 500 index funds).

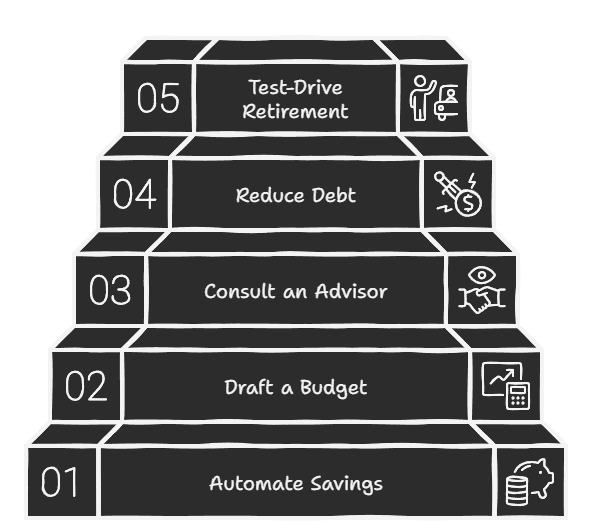

5 Steps to Start Today

- Automate Savings: Direct 10% of income to retirement accounts.

- Draft a Budget: Use Bankrate’s Budget Calculator to estimate retirement expenses.

- Consult an Advisor: A fiduciary can optimize Social Security timing and tax strategies.

- Reduce Debt: Aim to enter retirement mortgage-free.

- Test-Drive Retirement: Live on 80% of your income for 6 months to adjust spending habits.

Retirement Readiness Checklist

| Age | Action Items |

|---|---|

| 25–35 | Start 401(k), build emergency fund, avoid debt |

| 35–50 | Max employer match, diversify investments |

| 50–65 | Catch-up contributions, plan Social Security, enroll in Medicare |

Learn more about Saving for a Down Payment – Down Payment Savings Trends in 2025 – Smart Finance Decisions with Data Insights

Bottom Line

The best time to start planning for retirement was yesterday—but the next best time is right now. Whether you’re 25, just starting your career, or 65 and nearing retirement, every small step you take today can make a big difference in securing your financial future. The key is to start where you are, make smart decisions, and build a retirement plan that ensures long-term stability and peace of mind.

For personalized advice, use the Social Security Retirement Calculator or consult a certified financial planner.